Statistical indicators on Romania’s telecom sector in 2012 show that the market stabilised in comparison to the first years of crisis and that there is enough room for growth particularly on the internet segment, despite the challenging market environment.

Mobile and fixed telephony recorded annual decline in the number of users in 2012, while voice and message traffic continued to increase last year. The fixed telephony segment maintained a downward path both in terms of traffic and number of users.

The internet services segment kept accelerated expansion pace in 2012. The number of mobile broadband connections surged by 67.8% y/y to 7.1mn in 2012, while the fixed broadband internet connections advanced by 7.9% y/y. The segment has good prospects for further growth, as despite the accelerated dynamics in the recent years, internet usage in Romania remains below the EU average. Approximately 48% of the population has never used internet services, compared to 22% EU average.

Figure 1 Fixed and mobile telephony penetration degree in 2009-2012

Figure 2 Internet: Broadband connections by connection type in 2010-2012 (mn)

This is just a quick glimpse into the Intellinews Report: Romania Telecom Sector. Learn more and purchase now>>

Tags: ARPU, broadband, Cosmote, Deutsche Telekom, development, digital TV, equipment, fixed line, internet, investments, merger, Mobile, Orange Romania, pay TV, RCS&RDS, retail sales, revenues, Romania, share, Slovak, telecom, telephone, UPC Romania, Vodafone

The Polish tourism industry benefited from the organisation of Euro 2012 championship last year. The number of foreign tourists visiting Poland in 2012 was the highest in five years, while the spending of foreign tourists reached the highest level since 2000. The total spending of foreign visitors in Poland during the Euro 2012 totaled PLN 1bn (EUR 247.7mn).

However, the effect of the sports event upon revenues in the tourism sector were not limited to boosting sales in June alone, but also rose the foreign visitors’ interest in Poland and extended the tourism season to September and October, thus allowing the sector to record higher revenues even in Q4.

In 2012, the total contribution of the travel and tourism sector to the GDP reached PLN 80.4bn (EUR 19.2bn), or 5% of GDP, up from PLN 75.9bn in 2011, according to estimates of the World Travel & Tourism Council.

Figure 1 Total contribution of travel&tourism to GDP in 2007-2013f (PLN bn)

Much more in the Intelinews report: Polish Tourism, Hotels & Restaurants Report

Tags: Accor, agencies, airports, AmRest, Bachleda Hotel, Capacity, catering, chain, Charley's, condohotels, DeSilva, developer, Domestic, Dominos Pizza, food, forecast, foreign, franchising, Gromada, Hilton, holiday, HoReCa, Hospitality, hotels, Infrastructure., investments, McDonald’s, Motel One, outbound, Poland, Polish, prices, restaurants, rooms, sector, Sfinks, spending, Subway, tourism, tourists, TRIPS

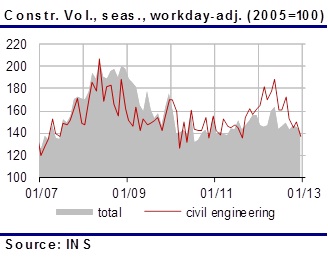

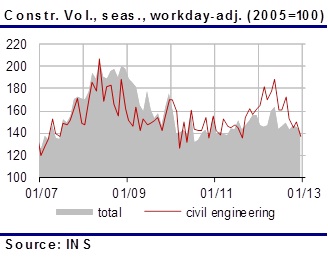

The construction works volume index shrank by 0.2% y/y in 2012, turning negative area after the 2.8% y/y growth in 2011. The construction works dynamics recorded encouraging performance in H1, but the activity in the sector weakened abruptly in the second half of the year, affected by the political turmoil in Jul-Aug and further by the government’s decision to cut public funding for infrastructure in the autumn budget adjustment.

The real estate market appear to have stabilised at low levels in 2012. The value of real estate transactions inched up by approximately 6.3% y/y last year, but the total remains below EUR 1bn annual average in the pre-crisis years. Investors and developers maintain cautious as most projects are currently financed through their own resources, yet the retail segment remains dynamic and new schemes continue to emerge.

Learn more from our Intellinews report: Romania Construction and Real Estate Sector

Tags: AFI Europe, apartments, Astaldi, Belgian Mitiska Ventures, Carrefour, CNADNR, construction, cost, Delta ACM, Dutch Van Oord, financial, government, Immochan, Infrastructure., investments, investor, Italo-Romena bank, NEPI, offices, prices, public roads, Public Roads Company, real estate, residential property, retail stock, Romania, Spanish Graells&Llonch, Swedish Skanska, Transilvania Constructii, transport ministry

The Indian banking industry has witnessed a period of steady growth during the last decade, with banks along with their customers embracing robust systems and processes. The industry has recorded a consistent rise in the number of reporting offices in last few years. With Reserve Bank of India stressing the policy of financial inclusion, there has been a renewed emphasis on rural expansion. However, a large part of Indian village population still remains without banks. It will require further expansion from Indian banks to raise the penetration levels of banking services in the country, especially in rural areas, home to more than 65% of Indian population.

Following rapid growth experienced in the past few years, the Indian banking industry experienced a slowdown in FY13. Persistent high inflation forced the RBI to maintain the benchmark interest rate at high levels. This slowed down the credit off take in the country, which led to an industrial slowdown. Except agricultural loans and personal loans, all other sectors recorded subdued loan growth. High inflation also eroded domestic savings, resulting in a lower deposit growth. However, higher interest rates and volatile market conditions attracted more depositors towards the high yielding and risk free term deposits of scheduled commercial banks. The prevailing adverse economic conditions deteriorated the asset quality of the commercial banks, particularly the public sector banks. High interest rates during the period led to a sharp increase in non-performing assets in public sector banks, bringing their profitability under pressure. The government of India has embarked upon a need-based recapitalization of public sector banks so that they can comply with Basel III norms. The norms will be fully phased in by March 31, 2018.

In a recent development, the Reserve Bank of India finalized the guidelines on licensing of new banks in the private sector. It also invited applications for licenses from eligible promoters with a cut-off date of July 1, 2013. Hence, the long term outlook for Indian banking sector is stable because of a large unbanked population, rising per capita income and a growing middle class. Emergence of new players and technology upgrades will further add to the growth of this sector.

Key Findings

- As of March 31, 2012, the total assets of scheduled commercial banks of India were around INR 83tn (USD 1.5tn). In the 2007-12, the total assets of the scheduled commercial banks grew at a CAGR of 19.1%.

- In January 2013, the Reserve bank of India cut the CRR (cash reserve ratio) by 25 basis points to 4% to infuse an amount equivalent to INR 180bn in the banking system. Since January 2012, the CRR has effectively been cut by 2% points which has infused a liquidity equivalent to INR 1,325 bn into the banking system. RBI used it as an alternate route to revive growth in 2012.

- In December 2012, the total loans and advances of the banking system grew by 17.6% y/y. Investment grew by 14.4% while balances with banks and money at call or short notice grew by 1.7%. Balances with RBI registered a steep decline of 15.2% as a result of reduction in CRR rate.

- Total deposits of scheduled commercial banks grew by 11% y/y at the end of December 2012. This was much below its long term growth trend of 19%. High inflation caused an erosion in the domestic savings of people, resulting in subdued growth in deposits.

Chart: Inflation during calendar year 2012-India (in %)

Source: RBI

This is just a quick glimpse into the EMD Report: India Banking Industry. Learn more and purchase now>>

Tags: Asset quality, assets, Borrowings, Capital adequacy, CRR, deposits, Foreign banks, hdfc bank, icici bank, inflation, investments, Liabilities, loans, Monetary policy, Net interest margin (NIM), Non-performing assets (NPA), Priority sector, Private sector banks, Public sector banks, Repo rate, Reserve Bank of India (RBI), return on assets, Scheduled Commercial Banks(SCBs), State bank of India (SBI), Tier I capital

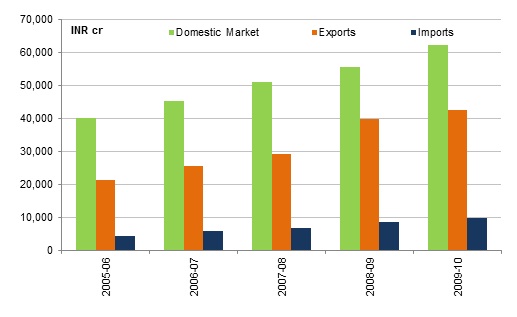

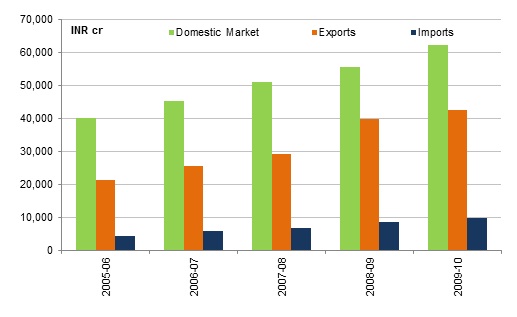

India Pharmaceutical & Healthcare provides an overview of the industry in Asia Pacific and India. India’s pharmaceutical industry grew by 9.7% year-on-year in 2009-10, largely due to robust growth in its domestic market. India’s healthcare industry is expected to grow 14% per year to reach USD 280 billion by 2020. Exports of drugs, pharmaceuticals and fine chemicals accounted for approximately 4.20% of the total national exports in 2010-11.

The report includes the market trends and outlook for the pharmaceutical and healthcare industries in India. We examine the country’s generic production, healthcare equipment, government schemes, TRIPS Compatibility, R&D initiatives, Pharmaceutical Export Promotion Council and India’s Vision 2015.

Also, the report encompasses the profile of leading players in the industry as well as their financial highlights and SWOT analysis. Among the leading players are Ranbaxy, Dr Reddy’s, Cipla and Lupin. Ranbaxy is India’s largest pharmaceutical company with operations in 23 of the top 25 pharmaceutical markets of the world.

Key Findings

- India’s pharmaceutical industry grew by 9.7% year-on-year in 2009-10, largely due to robust growth in the domestic market.

- India’s healthcare industry is expected to grow 14% per year to reach USD 280 billion by 2020.

- According to government statistics, exports of drugs, pharmaceuticals and fine chemicals throughout 2010-11 stood at INR 47,551 cr after a robust growth of 12.0% over 2009-2010.

India Pharmaceutical Sector

Source: Department of Pharmaceuticals

These are only a few of the insights in the new EMD Report : India Pharmaceutical Industry. Learn more and purchase now>>

Tags: Asia-Pacific, Bengal Chemicals and Pharmaceuticals, Bengal Immunity, bulk drugs, Cipla, Dr Reddy’s, drug prices, equipment, export, FDI, FICCI, formulation packs, GDP, generic drug, government schemes, health statistics, healthcare, Hindustan Antibiotics, import, India, Indian Drug and Pharmaceuticals, investments, Lupin, medicinal, NIPER, NPPA, patent, pharmaceutical, pharmaceutical trade, pharmaceutical units, Pharmexcil, PSU, public sector undertakings, R&D initiatives, Ranbaxy, Smith Stanistreet Pharmaceuticals, TRIPS, US FDA

Next to India and China, Indonesia represents one of the largest potential insurance markets in Asia. According to the Indonesian credit rating agency PEFINDO, life insurance coverage in Indonesia is still low at around 15% of the country’s population. Indonesia has seen steady growth in insurance premiums given the low penetration rate for insurance services, at merely 2% of GDP in 2011 as compared to over 4% in neighboring countries such as Singapore, Malaysia and Thailand. This has attracted many foreign investors to participate in the domestic insurance industry.

Indonesia’s solid economy is also fuelling growth for a developing insurance market, supported by rising domestic consumption, expanding government infrastructure spending and strengthening regulatory requirements. In line with these positive conditions, the life and non-life insurance sectors have seen steady growth in total assets and gross premiums over the years. Life insurance dominates the industry’s market share, accounting for 60% of total gross premiums in 2010.

As the country with the largest Muslim population in the world, Indonesia has a vast untapped sharia market. Fitch Ratings reported that gross premium of sharia insurance was less than 5% of total insurance market premiums in 2011. Industry analysts believe that the national sharia market will benefit from further growth due to the less established market and improved regulatory environment.

Key Findings

- The life insurance sector will continue to grow as the penetration rate is low, merely 2% of GDP, and life insurance coverage in Indonesia is still below 15% of the country’s population.

- Gross premiums for the life and non-life insurance sectors have continued to grow steadily over the years, reaching IDR 125tn in 2011 and contributing over 80% to total insurance industry premiums.

- The frequency of mergers and acquisitions (M&As) is set to increase, driven by the increased capital requirement, which may force local insurers having problems raising capital to joint venture with foreign partners.

These are only a few of the insights in the new EMD Report : Indonesia Insurance Industry 2H12. Learn more and purchase now>>

Tags: assets, civil service and armed forces insurance, density, foreign ownership, gross claims, gross premiums, Indonesia, insurance, insurance companies, investments, life insurance, net premium, non-life insurance, penetration, PT Asuransi Bina Dana Arta Tbk, PT Asuransi Multi Artha Guna Tbk, PT Panin Insurance Tbk, regulatory developments, reinsurance, retention rate, sharia market, size, social insurance, value

Indonesia has a fairly small but fast-growing pharmaceutical market, with an estimated value of USD 7.31bn in 2012. The pharmaceutical market is projected to grow at a compound annual growth rate of 10.8%, reaching a value of USD 12.2bn by 2017. It is expected that the market will further grow as current drug consumption per capital is relatively lower than neighbouring countries at about USD 20 in 2011, hence there likely will be increases in health spending in the future.

Due to a large population size and relatively strong production base, Indonesia has the potential to be a lucrative pharmaceutical and healthcare market. The country has a huge generic drugs sector, which is likely to see consolidation as larger companies seek to maximise profits through acquisition of smaller domestic companies. However, it is noteworthy that part of the generics market is made up of counterfeit drugs. Over-the-counter (OTC) segment has also shown steady growth in recent years, attributed to increased self-medication and accessibility to more affordable drugs.

Majority of the local pharmaceutical companies achieved better sales growth in 2011-12, supported by improved macro-economic conditions and stable raw material import prices. The leading players include PT Kalbe Farma Tbk, PT Merck Tbk, and PT Kimia Farma Tbk.

Salient Points

- Indonesia’s pharmaceutical market is projected to grow at a CAGR of 10.8% over the next five years, reaching USD 12.2bn by 2017, and will rank as the sixth largest pharmaceutical market in the Asia-Pacific region.

- According to industry estimates, drug expenditure is projected to reach IDR 84.8tn (USD 9.5bn) by 2016, with a CAGR of 10% during the 2011–2016 period.

- Healthcare spending in Indonesia, which is equivalent to 2.6% of GDP, is projected to nearly double over the next five years, driven by strong economic, demographic and income growth, as well as the eventual introduction of the national health insurance system by 2014.

Indonesia’s Projected Pharmaceutical Market, 2012–2017

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

| Market Value (USD billion) |

7.31

|

8.05

|

8.89

|

9.98

|

11.14

|

12.20

|

| % GDP |

0.8

|

0.8

|

0.7

|

0.7

|

0.7

|

0.7

|

| % Health Expenditure |

30.3

|

29.3

|

28.4

|

27.4

|

26.6

|

25.8

|

| Per Capita Expenditure (USD) |

29

|

32

|

35

|

39

|

43

|

47

|

Source: Espicom Business Intelligence

Much more in the EMD report: Indonesia Pharmaceutical Industry

Tags: Asia-Pacific, counterfeit drugs, drug consumption, drug patent, establishments, ethical drugs, exports, foreign support, generic drugs, health expenditure, healthcare, imports, Indonesia, industry SWOT, intellectual property rights, investments, Kalbe Farma, Kimia Farma, leading players, market outlook, medications, Merck, mergers and acquisitions, Ministry of Health, OTC medicines, People’s Pharmacy, performance, pharmaceutical, pharmaceutical companies, pharmaceutical raw materials, prescription drugs, production, regulations, sector size, value

Construction works volume index grew by 9.1% y/y in Q2 and by 6.8% y/y in H1/2012, according to official statistics. The works for engineering projects surged by 17.1% y/y in Q2 and 18.1% y/y in H1, remaining the sector’s growth driver. Nonetheless, the construction works volume dropped by 4.6% y/y in July, losing ground immediately after the June 10 local elections had driven up the index in Q2. The construction sector’s dynamics and its contribution to the GDP growth are likely to witness abrupt weakening in H2, as the government cut down significantly public funding for infrastructure under the autumn budget adjustment and construction works on large projects, such as motorways and Bucharest underground sections had to be slowed down.

Figure 1 Construction works index in 2007-2012 (2005=100)

These are only a few of the insights in the new IntelliNews : Romania Construction and Real Estate Report. Learn more and purchase now>>

Tags: apartments, Astaldi, Carrefour, Consortium, construction, cost, financial, government, Infrastructure., investments, investor, NEPI, offices, prices, public roads, real estate, residential property, retail stock, Romania, Somet SA, TIAB SA, transport ministry