The cement industry is one of the strategic industries of Malaysia. It acts as the feeder to several other industries like real-estate, construction and infrastructure. The industry witnessed a period of subdued growth during 2006-10. However, cement consumption has grown in the last two years owing to the development of key infrastructure projects under the 10th Malaysia Plan and Economic Transformation Programme (ETP).

The recent growth in demand for cement is driving companies towards capacity expansion. By the end of 2013, the total installed capacity in Malaysia is expected to increase by around 25%. Many companies have commissioned new projects for enhancing their existing capacity. Around 80% of cement produced in Malaysia is consumed by the domestic market itself and the remainder is exported. Indonesia, Singapore and Sri Lanka are the major export destinations. Annual cement consumption recorded a growth of more than 5% y/y in 2012 backed by strong demand arising from residential and civil construction sectors.

The outlook for the Malaysian cement industry is positive backed by stable domestic demand and government support for infrastructure development under the 10th Malaysia Plan and ETP. The major challenges in front of the Malaysian cement industry are rising fuel prices and rising transportation costs. The industry will also have to meet global pollution and emission standards which will take considerable amount of investment.

Key Findings

- The Malaysian government has allocated MYR 230bn for development expenditure under the 10th Malaysia Plan (2011-15). The government has decided to invest substantive portion of the amount in developing infrastructure across the country.

- The recent growth in demand for cement is driving companies towards capacity expansion. By the end of 2013, the total installed capacity in Malaysia is expected to increase by around 25%. West Malaysia leads in terms of integrated production capacity accounting for around 90% of the existing capacity while East Malaysia accounts for 10%.

- During 2006-10, the annual cement consumption in Malaysia was stagnant and grew at a CAGR of only 0.5%. However, the industry has witnessed a steep demand recovery in the last two years. In FY12, the consumption grew by 5.9% y/y after growing by 6.3% y/y in FY11.

- Rise in cement demand has also led to increased imports of cement in the country. The ratio of imports as a percentage of total consumption rose to 20% in FY12. The major portion of imports predominantly came from China.

Chart: Per capita cement consumption trend in Malaysia (in kg)

Source: EMIS

This is just a quick glimpse into the EMD Report: Malaysia Cement Industry. Learn more now>>

Tags: 10th Malaysia Plan, Capacity, CIMA, CMS Cement, construction, Consumption, East Malaysia, Economic Transformation Programme, exports, GDP, Infrastructure., Lafarge Malaysia, Peninsula, Perak, production, residential, Tasek Corp, West Malaysia, YTL Cement, YTL Corp

During the last five years, the Indian cement industry has shown resilience even amidst the global financial crisis. It is one of the eight core industries of the Indian economy. As of 2012, India was the second largest producer of cement in the world behind China. There has been a surge in capacity, consumption as well as production of cement during the last five years. However, per capita cement consumption in India is still amongst the lowest in the world. The vast potential that exists in the industry has attracted investors from all round the world. Three of the top four cement producers of the world have an established presence in India.

India’s cement industry witnessed growth even amidst a grim economic situation in the country in FY13. The demand supply gap that existed in the sector has allowed the cement companies to stay profitable. Housing and government spending on infrastructure were the major drivers of growth for the industry. Although the installed capacity has increased in the past few years, the cement companies of India were not able to utilize it to full extent. The industrial slowdown and consequent moderation in demand for cement resulted in a lower capacity utilization for the industry in the last four years. Furthermore, the rising cost of production brought the operating margins of Indian cement companies under pressure at the end of FY13.

However, the long term outlook for Indian cement industry is positive owing to a steady growth in housing and infrastructure development. Domestic consumption is expected to drive growth and expansion in the industry.

Key Findings

- Government spending on infrastructure has been a major source of growth for the sector. As of FY12, the investment in infrastructure was at 8.37% of GDP. This figure is projected to grow to 10.70% of GDP by the end of 12th Plan period (2012-17).

- During 2006-12, the annual cement consumption in India grew at a CAGR of 10%. In FY13, the consumption grew by 9.5% y/y, recording a recovery after witnessing a tepid 7.1% y/y growth in FY12. Government spending was one of the main drivers of this recovery.

- During 2008-13, the country’s installed production capacity increased at a CAGR of 12.1%. However, the addition in capacity did not result in a corresponding increase in production and demand. Hence, the industry’s capacity utilization has declined in the last four years.

- During 2008-13, the production index for eight core industries recorded a CAGR of 4.9%. Cement industry outperformed the overall growth by recording a CAGR of 7.6% during the same period. In FY13 too, while the overall production index recorded a 1% y/y growth, cement industry recorded a y/y growth of 9%.

Chart: Y/Y change in Index of industrial production (Base 2004-05=100)

Source: Ministry of Statistics and Program Implantation (MOSPI)

These are only a few of the insights in the new EMD Report : India Cement Industry. Learn more >>

Tags: ACC, Ambuja, Capacity, Consumption, Core, demand, Department of Industrial Policy and Promotion (DIPP), export, government, Holcim, Index of Industrial Production (IIP), India Cements, Infrastructure., Margin, Ministry of Commerce and Industry, Per capita, Planning Commission of India, prices, private, production, Realization, Region, Shree Cements, UltraTech, WPI

The Indian healthcare industry continued to show resilience in the face of slowdown in FY13 with leading healthcare players recording a double digit growth, both in revenues and net profits. The country is ranked amongst the lowest in the world in terms of government spending on infrastructure. Huge demand-supply gap exists in the Indian healthcare sector. The country lags behind in terms of average number of hospitals, hospital beds, doctors, nurses and other paramedical staff. The huge population accompanied with large prevalence of communicable and non-communicable diseases demands large scale development and growth in this sector. Private sector is playing a big role in this regard accounting for around 70% of the country’s health expenditure.

The government’s flagship programme National Rural Health Mission (NRHM) has been quite successful in raising the standards of people’s health, healthcare infrastructure and healthcare delivery across the country within a short span of seven years. Buoyed by the success of NRHM in raising the rural health standards, the government grouped the National Urban Health Mission with NRHM under one umbrella programme named as the ‘New National Health Mission’.

The outlook for Indian healthcare is positive owing to double digit growth rate in almost all of its segments, whether its primary healthcare, secondary and tertiary healthcare, health insurance or medical tourism. The ever growing population, increasing government expenditure on health and growing per capita income will increase the size of this industry in the years to come.

Key Findings

- The central government of India increased the budgeted allocation on Ministry of Health and Family Welfare by 7% in FY14. Almost 65% of the government spend was on its flagship programme New National Health Mission.

- The healthcare industry has been riding the economic wave in terms of increase in per capita health expenditure which grew at a CAGR of 12% during the period 2005-11.

- According to World Health Organization, the size of India’s healthcare industry was around USD 73bn as of year 2011. Government accounted for around 31% of the total spending while the private sector accounted for the remainder.

- Healthcare has become the preferred choice of foreign investors in the last few years. Capital flows from private equity players, venture capitalists, institutional investors and multinational companies have increased in last few years. In the first half of 2013, the sector registered 25 deals with a value of USD 352mn. The sector was second only to technology sector in terms of deals made in 2012.

Chart 28: Private equity investments in healthcare sector (In USD mn)

Source: The Economic Times

These are only a few of the insights in the new EMD Report : India Healthcare Industry.

Learn more >>

Tags: Apollo Hospitals, AYUSH, Beds, Birth Rate, Child Mortality Rate, Fortis Healthcare, government, health insurance, Hospital, Human Resources, Infant Mortality Rate, Infrastructure., investment, Maternal Mortality Rate, Max India Ltd, Medical Tourism, Ministry of Health, National Rural Health Mission (NRHM), private sector, Shortage

Indonesia’s GDP grew by a robust 6.2% in 2012, driven by strong domestic consumption and investment. The Indonesian cement industry also witnessed high growth in capacity, consumption as well as production of cement. The country is the second-largest consumer of cement in ASEAN, with total cement consumption of 55mn tonnes by year end. However, it still lags behind its peers in terms of per-capita consumption.

Total cement production reached 52mn tonnes in 2012 while designed capacity grew to 60mn tonnes. Annual cement consumption grew by 14.5% in 2012 backed by strong demand from the housing and construction sectors. To cash in on this rising demand, leading cement companies have charted out aggressive expansion plans. As such, the country’s total designed capacity is expected to increase to 80mn tonnes by 2015.

The first five months of FY13 also reflected a similar trend with growth in both consumption and production of cement. However, cement consumption was disproportional to cement production in this period, highlighting the huge demand for cement in the country. Cement consumption touched 22.9mn tonnes in the January-May period while production lagged behind at 21.8mn tonnes.

The industry is dominated by three players who represent over 85% of total cement sales: Semen Indonesia, Indocement and Holcim Indonesia. The outlook for the Indonesian cement industry is positive, attributed to strong economic prospects as well as low current consumption per capita.

Key Findings

- Indonesia’s domestic cement consumption grew by 14.5% to 55mn tonnes in 2012, making it the second-largest cement industry in the ASEAN region.

- Total designed capacity is expected to reach 80mn tonnes by 2015 in line with demand growth, up from the current 60mn tonnes.

- Total cement exports have declined significantly over the last few years owing to a surge in domestic demand. In 2012, total exports plunged 84%.

- Semen Indonesia is the leader in terms of sales, designed capacity and production. In 2012, the company had a 41% domestic market share based on sales volume. It was followed by Indocement and Holcim with a share of 32% and 15%, respectively.

Much more in the EMD report: Indonesia Cement Industry>>

Tags: ASEAN, bag, bulk, Capacity, cement, Concrete, construction, Consumption, exports, GDP, Holcim Indonesia, Housing, imports, Indocement, Indonesia, Infrastructure., islands, Java, Kalimantan, prices, production, sales, Semen Andalas, Semen Baturaja, Semen Bosowa Marus, Semen Indonesia, Sumatera, SWOT analysis

The Polish tourism industry benefited from the organisation of Euro 2012 championship last year. The number of foreign tourists visiting Poland in 2012 was the highest in five years, while the spending of foreign tourists reached the highest level since 2000. The total spending of foreign visitors in Poland during the Euro 2012 totaled PLN 1bn (EUR 247.7mn).

However, the effect of the sports event upon revenues in the tourism sector were not limited to boosting sales in June alone, but also rose the foreign visitors’ interest in Poland and extended the tourism season to September and October, thus allowing the sector to record higher revenues even in Q4.

In 2012, the total contribution of the travel and tourism sector to the GDP reached PLN 80.4bn (EUR 19.2bn), or 5% of GDP, up from PLN 75.9bn in 2011, according to estimates of the World Travel & Tourism Council.

Figure 1 Total contribution of travel&tourism to GDP in 2007-2013f (PLN bn)

Much more in the Intelinews report: Polish Tourism, Hotels & Restaurants Report

Tags: Accor, agencies, airports, AmRest, Bachleda Hotel, Capacity, catering, chain, Charley's, condohotels, DeSilva, developer, Domestic, Dominos Pizza, food, forecast, foreign, franchising, Gromada, Hilton, holiday, HoReCa, Hospitality, hotels, Infrastructure., investments, McDonald’s, Motel One, outbound, Poland, Polish, prices, restaurants, rooms, sector, Sfinks, spending, Subway, tourism, tourists, TRIPS

The construction and assembly index dropped by 1% y/y in 2012, marking a negative growth after the double-digit annual advance recorded in 2011. After a good performance in H1, the situation in the sector deteriorated abruptly in H2/2012 as infrastructure spending, the main growth driver in the past few years, was expected to fall with the completion of the main road building projects ahead of the Euro 2012 soccer championship.

The construction sector is expected to face challenges in 2013 and the coming years as well, particularly on the public building segment, but the outlook for the sector is not entirely gloomy, as the lowering demand from infrastructure can be replaced by alternatives in sectors such as rail and energy. However, overall the construction sector is expected to see visible recovery only in 2015, when EU co-financed projects for 2014-2020 are launched.

Figure 1 Constructions sector – Selective indicators in 2005-2012 (annual, y/y)

Much more in the Intelinews report: Polish Construction Sector

Tags: bankrupticy, Budimex, building, civil engineering, construction, economy, employment, energy, environment, gas, GDP, homes, Housing, Infrastructure., Insolvent PBG, M&A, office, oil, PBG, permits, Pol –Aqua, Poland, Polimex-Mostostal, Polish, rail, retail, sector, sentiment, Skanska, Strabag, Warbud, warehouse

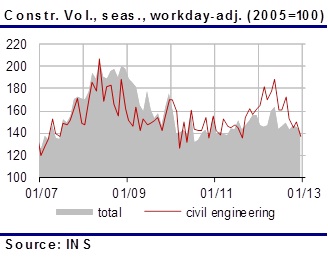

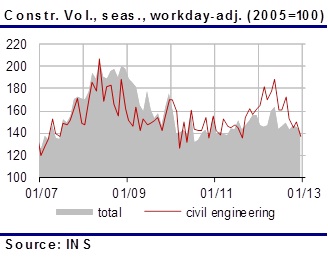

The construction works volume index shrank by 0.2% y/y in 2012, turning negative area after the 2.8% y/y growth in 2011. The construction works dynamics recorded encouraging performance in H1, but the activity in the sector weakened abruptly in the second half of the year, affected by the political turmoil in Jul-Aug and further by the government’s decision to cut public funding for infrastructure in the autumn budget adjustment.

The real estate market appear to have stabilised at low levels in 2012. The value of real estate transactions inched up by approximately 6.3% y/y last year, but the total remains below EUR 1bn annual average in the pre-crisis years. Investors and developers maintain cautious as most projects are currently financed through their own resources, yet the retail segment remains dynamic and new schemes continue to emerge.

Learn more from our Intellinews report: Romania Construction and Real Estate Sector

Tags: AFI Europe, apartments, Astaldi, Belgian Mitiska Ventures, Carrefour, CNADNR, construction, cost, Delta ACM, Dutch Van Oord, financial, government, Immochan, Infrastructure., investments, investor, Italo-Romena bank, NEPI, offices, prices, public roads, Public Roads Company, real estate, residential property, retail stock, Romania, Spanish Graells&Llonch, Swedish Skanska, Transilvania Constructii, transport ministry

Singapore’s economy saw a period of subdued growth in last three quarters due to slowdown in exports growth. However, Singaporean pharmaceutical industry continued its V-shaped recovery in year 2012 as well. The industry recorded growth in both production as well as exports of pharmaceuticals after the global recession of late 2000s.

The country is actively being looked as the pharmaceutical hub of Southeast Asia. . It is for this reason, that more than 30 leading pharmaceutical and biomedical science companies have established regional headquarters in Singapore including GlaxoSmithKline, Merck, Roche, Abbot and Sanofi. The country is also being preferred as a manufacturing base by leading multinational pharmaceutical companies. Seven of the top ten pharmaceutical companies of the world had a manufacturing base in the country as of June 2012.

Pharmaceutical manufacturing led the manufacturing sector of in last few quarters. It has performed well compared to other sectors and has been one of the major contributors to the overall growth of manufacturing in the country in the recent past. The country also acted as a major pharmaceutical trading hub of Southeast Asia and a substantive amount of pharmaceuticals were re-exported from the country. The export growth for pharmaceuticals was greater than the overall non-oil domestic exports of the country for most part of the year 2011 and continued its resilience in first half of 2012, even amidst the global slowdown.

The outlook for Singapore pharmaceuticals is positive owing to availability of skilled manpower, presence of leading research institutions, proactive government, relaxed regulatory environment, intellectual property protection and state of the art infrastructure. Added to that, the strategic geographic location of the country will attract multinational companies to establish a base in Singapore in the years to come.

Salient Points

- In fiscal year 2011, Singapore pharmaceutical industry recorded a production turnover of around USD 22bn. The total pharmaceutical production turnover of the country grew by 20% y/y in year 2011.

- Electronic hardware exports grew by 11% y/y and crossed SGD 21bn by the end of fiscal year 2011.

- At the end of second quarter of fiscal year 2012, the total manufacturing index grew by 4.5% on y/y basis. During the same period, the pharmaceutical manufacturing index grew by 30% y/y which was the highest among all the constituent sectors. Hence, despite the slowdown, pharmaceutical manufacturing sector of the country has shown resilience.

Chart: Index of Industrial Production (2011=100)

Source: Ministry of Trade and Industry

This is only a small extract of the insights in the Singapore Pharmaceutical Industry report; read more and purchase>>

Tags: Cardiovascular, China, Drugs, Economic Development Board (EDB), exports, Headquarters, Health, Hub, Infrastructure., Keywords: Singapore, Luye Pharma, manufacturing, medicine, Ministry of Trade and Industry (MTI), Non-oil Domestic Exports, Patents, pharmaceutical, Pharmesis International, Research, sales, Southeast Asia, Star Pharmaceuticals

Construction works volume index grew by 9.1% y/y in Q2 and by 6.8% y/y in H1/2012, according to official statistics. The works for engineering projects surged by 17.1% y/y in Q2 and 18.1% y/y in H1, remaining the sector’s growth driver. Nonetheless, the construction works volume dropped by 4.6% y/y in July, losing ground immediately after the June 10 local elections had driven up the index in Q2. The construction sector’s dynamics and its contribution to the GDP growth are likely to witness abrupt weakening in H2, as the government cut down significantly public funding for infrastructure under the autumn budget adjustment and construction works on large projects, such as motorways and Bucharest underground sections had to be slowed down.

Figure 1 Construction works index in 2007-2012 (2005=100)

These are only a few of the insights in the new IntelliNews : Romania Construction and Real Estate Report. Learn more and purchase now>>

Tags: apartments, Astaldi, Carrefour, Consortium, construction, cost, financial, government, Infrastructure., investments, investor, NEPI, offices, prices, public roads, real estate, residential property, retail stock, Romania, Somet SA, TIAB SA, transport ministry

Indian economy saw a period of slowdown in fiscal year 2012. The country recorded a GDP growth of 5.3% in the fourth quarter which was its worst performance in last nine years. However, Indian healthcare industry continued to show resilience in the face of slowdown with leading healthcare players recording a double digit growth, both in revenues and net profits. The industry is growing at a CAGR of 15% and is expected to cross USD 75 bn by the end of calendar year 2012.

The country’s government spending on infrastructure is low, approximately 1.2% of GDP in 2010. Fiscal year 2012 saw a 13% increase in government budget allocation to the flagship programme named National Rural Health Mission (NRHM). The programme has been quite successful in raising the standards of people’s health, healthcare infrastructure and healthcare delivery across the country within a short span of seven years. However, the country is likely to miss the healthcare targets for 2015 under Millennium Development Goals.

Huge demand supply gap exists in the healthcare sector of India. The country was lagging behind in terms of average number of hospitals, hospital beds, doctors, nurses and other paramedical staff. The huge population accompanied with large prevalence of communicable and non-communicable diseases demands large scale development and growth in this sector. Private sector is playing a big role in this regard accounting for more than 70% of country’s health expenditure.

The outlook for Indian healthcare is positive owing to double digit growth rate in almost all of its segments, whether its primary healthcare, secondary and tertiary healthcare, medical equipments, disgonotics, health insurance or medical tourism. The ever growing population, increasing government expenditure on health and growing per capita income will increase the size of this industry in the years to come.

Key Findings

- The Ministry of Health and Family Welfare increased the planned allocation on public health from USD 4.97 bn in FY11 to USD 5.96 bn in FY12, an increase of 20% y/y. The major stressor on the Indian government over the last few years has been raising the standards of rural health. Almost 75% of the government spend was on its flagship programme National Rural Health Mission (NRHM).

- The annual budget outlay for NRHM increased from INR 109 bn in FY08 to INR 178.4 bn in FY12. The budget outlay has grown at a CAGR of 13% during the fiscal period 2008-12.

- The size of India’s healthcare sector was around USD 66 bn as of year 2010. The sector size is expected to cross USD 75 bn by the end of calendar year 2012.

- The existing supply/demand gap is attracting investors to the healthcare sector of the country. In the first half of calendar year 2012, the sector registered 25 deals with a value of USD 749 mn. In the same period in year 2011, it recorded equity investment of USD 208 mn only. Health care received the highest investment, surpassing the long preferred information technology sector, in terms of total private equity investments during this period.

Chart: Private Equity Investments in First Half of Calendar Year 2012 (In USD Mn)

Source: The Economic Times

Much more in the Emerging Markets Direct report: India Healthcare Industry 1H12

Tags: Apollo Hospitals, AYUSH, Beds, Birth, Child Mortality, Equipments, Fortis Healthcare, government, health insurance, Hospital, Human Resources, Infant Mortality, Infrastructure., Keywords: National Rural Health Mission (NRHM), Maternal Mortality, Medical Tourism, Ministry of Health, Opto Electronics., private sector, Shortage, size