Real estate sector has been one of the key drivers of Indian economic growth during the last decade. The housing sector of India ranks fourth in terms of multiplier effect on the economy. However in last few quarters, persistent inflation and high interest rates caused a dent in the growth of this sector. Affordability is a major concern for middle class Indians and a steady rise in housing prices together with high interest rates and inflation has neither helped their cause, nor has it benefited the real estate sector. As a result, experts are predicting a price correction in the housing sector of the country.

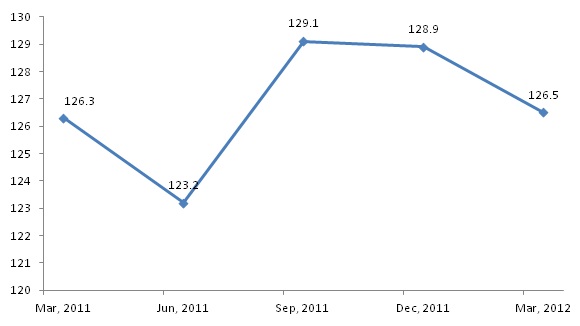

The sector showed some signs of recovery in the second half of 2012 with growth in number of transactions as well as improvement in absorption rates. However, the pessimistic growth and inflation figures witnessed in early 2013 again brought a slump in the market. A price correction took place in the commercial lease and rental segments of major cities. The slowdown in economic growth and vacant office spaces acted as catalysts in lowering rental prices of commercial properties in major hubs of the country. Residential prices, though, showed resilience and registered growth. The housing transaction volume index declined in the first three months; grew briskly in the next six and remained flat in the last three months in 2013. After a subdued first half of 2012, the index rose in the second half of 2012. BSE Reality Index, which represents the largest companies in the sector, rose in the second half of 2012 but witnessed a sharp decline in the first half of 2013.

The near term outlook for Indian property is negative because of low absorption, high interest rates and high inflation. Most of the leading real estate players are suffering from high debt levels and low profitability. However, looking at long term, the large supply/demand gap in the residential market and rising per capita income of Indians, along with increasing urbanization bodes well for this sector.

Key Findings

- In a report published by the Ministry of Housing and Urban Poverty Alleviation, it was estimated that at the start of 12th five year plan (2012-17) the total urban housing shortage in the country was around 18.78mn.

- According to Economic Survey of India 2012-13, the real estate sector accounted for around 10.8% of GDP as of FY12. The housing sector ranked fourth in terms of multiplier effect on the economy. During the period 2008-12, the sector grew at a CAGR of 11%.

- Between January 2000 and March 2013, real estate and construction development sector witnessed a cumulative FDI of USD 22bn. The sector accounted for 11% of the total cumulative FDI received during this period.

- The combined market capitalization of the companies listed on the BSE realty index was around USD 10bn as of August 20, 2013. After a subdued first half of 2012, the index rose in the second half of 2012. However, it again witnessed a sharp decline in the first half of 2013.

Chart: Monthly average closing price of BSE Realty Index (in INR)

Source: BSE

Read more in EMD’s comprehensive report, India Property Industry>>

Tags: Bangalore, commercial, Delhi, DLF, Hospitality, Housing, Housing and Urban Development Corporation (HUDCO), Inventory, Ministry of Housing and Urban Poverty Alleviation (MHUPA), Mumbai, National Housing Bank (NHB), Oberoi Realty, office, price, real estate, rental, Reserve Bank of India (RBI), residential, retail, sales, Sobha Developers, Vacant

Indonesia’s GDP grew by a robust 6.2% in 2012, driven by strong domestic consumption and investment. The Indonesian cement industry also witnessed high growth in capacity, consumption as well as production of cement. The country is the second-largest consumer of cement in ASEAN, with total cement consumption of 55mn tonnes by year end. However, it still lags behind its peers in terms of per-capita consumption.

Total cement production reached 52mn tonnes in 2012 while designed capacity grew to 60mn tonnes. Annual cement consumption grew by 14.5% in 2012 backed by strong demand from the housing and construction sectors. To cash in on this rising demand, leading cement companies have charted out aggressive expansion plans. As such, the country’s total designed capacity is expected to increase to 80mn tonnes by 2015.

The first five months of FY13 also reflected a similar trend with growth in both consumption and production of cement. However, cement consumption was disproportional to cement production in this period, highlighting the huge demand for cement in the country. Cement consumption touched 22.9mn tonnes in the January-May period while production lagged behind at 21.8mn tonnes.

The industry is dominated by three players who represent over 85% of total cement sales: Semen Indonesia, Indocement and Holcim Indonesia. The outlook for the Indonesian cement industry is positive, attributed to strong economic prospects as well as low current consumption per capita.

Key Findings

- Indonesia’s domestic cement consumption grew by 14.5% to 55mn tonnes in 2012, making it the second-largest cement industry in the ASEAN region.

- Total designed capacity is expected to reach 80mn tonnes by 2015 in line with demand growth, up from the current 60mn tonnes.

- Total cement exports have declined significantly over the last few years owing to a surge in domestic demand. In 2012, total exports plunged 84%.

- Semen Indonesia is the leader in terms of sales, designed capacity and production. In 2012, the company had a 41% domestic market share based on sales volume. It was followed by Indocement and Holcim with a share of 32% and 15%, respectively.

Much more in the EMD report: Indonesia Cement Industry>>

Tags: ASEAN, bag, bulk, Capacity, cement, Concrete, construction, Consumption, exports, GDP, Holcim Indonesia, Housing, imports, Indocement, Indonesia, Infrastructure., islands, Java, Kalimantan, prices, production, sales, Semen Andalas, Semen Baturaja, Semen Bosowa Marus, Semen Indonesia, Sumatera, SWOT analysis

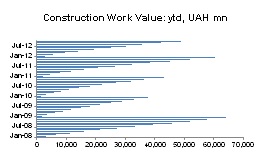

The construction and assembly index dropped by 1% y/y in 2012, marking a negative growth after the double-digit annual advance recorded in 2011. After a good performance in H1, the situation in the sector deteriorated abruptly in H2/2012 as infrastructure spending, the main growth driver in the past few years, was expected to fall with the completion of the main road building projects ahead of the Euro 2012 soccer championship.

The construction sector is expected to face challenges in 2013 and the coming years as well, particularly on the public building segment, but the outlook for the sector is not entirely gloomy, as the lowering demand from infrastructure can be replaced by alternatives in sectors such as rail and energy. However, overall the construction sector is expected to see visible recovery only in 2015, when EU co-financed projects for 2014-2020 are launched.

Figure 1 Constructions sector – Selective indicators in 2005-2012 (annual, y/y)

Much more in the Intelinews report: Polish Construction Sector

Tags: bankrupticy, Budimex, building, civil engineering, construction, economy, employment, energy, environment, gas, GDP, homes, Housing, Infrastructure., Insolvent PBG, M&A, office, oil, PBG, permits, Pol –Aqua, Poland, Polimex-Mostostal, Polish, rail, retail, sector, sentiment, Skanska, Strabag, Warbud, warehouse

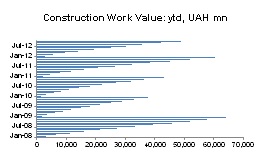

Ukraine’s construction sector managed to emerge from the deep recession seen in 2008 and post a growth of 11.1% y/y in 2011. Thanks to the EURO 2012 preparations. However, the growth will likely slow down this year amid struggling economy and the absence of private sector investment.

Throughout 2012, the best results were reported by the primary market of Kiev residential housing. As analysts are pointing out, this segment is expanding following adequate pricing policy and installment programs provided by the developers.

In general, residential housing prices have been slipping during the year due to global economic slowdown and the population’s weak purchasing capacity. This, alongside with the absence of mortgaging and growing tax rates led to market stagnation. In January to October, construction works in the country declined by 10.2% y/y to UAH 48.8bn (USD 6bn), the State Statistics service said.

This is just a quick glimpse into the Intellinews Report: Ukraine Construction Sector. Learn more and purchase now>>

Tags: clinker, construction, euro 2012, Eurocement, Fozzy Group, HeidelbergCement Ukraine, hotels, Housing, industrial premises, Investbudservis, KAN development, Kerameya, Kyivmiskbud, Metro, Novus, office, Podilsky Cement, prices, real estate, retail trade, shopping centers, Spar, TMM, Vektor Production

The Indian economy experienced an economic slowdown with high inflation in fiscal year 2012. India’s property industry suffered a major slowdown with declining sales and rising inventory levels in the first half of 2012. In August 2012, the Indian finance minister said in a meeting with the heads of public sector banks that around 500,000 flats were lying vacant in Mumbai despite a robust demand for housing. Affordability is a major concern for middle class Indians and a steady rise in housing prices together with high interest rates and inflation has neither helped their cause nor benefited the real estate sector. As a result, experts are predicting a price correction in the housing sector of the country.

In the first half of 2012, a price correction took place in the commercial lease and rental segments of major cities. The slowdown in economic growth and vacant office spaces acted as catalysts in lowering rental prices of commercial properties. Residential prices, though, showed resilience and registered growth. The housing transaction volume index declined in the first three months, further indicating sluggish sales in the sector. An increase in residential property prices, despite decline in sales, highlights the presence of a bubble in the housing segment of the country, marked by an artificial demand creation.

The near term outlook for Indian property is negative because of declining sales, high interest rates and high inflation. Most of the leading real estate players are suffering from high inventory levels which may create working capital problems. However, looking at long term, the large supply/demand gap in the residential market and rising per capita income of Indians, along with increasing urbanization makes this sector stable.

Key findings

- In a report published by Ministry of Housing and Urban Poverty Alleviation, it was estimated that at the start of 12th five year plan (2012-17), the total urban housing shortage in the country was around 18.78mn.

- According to National Housing Bank Residex, 6 of the 14 cities recorded a y/y decline in housing price index in the second quarter of 2012. However, all four metropolitans, Mumbai, Delhi, Chennai and Kolkata, recorded growth in housing price for this period.

- Commercial property rentals went through a decline in the first half. Mumbai central business district, the third most expensive commercial hub, saw a y/y price decline of around 15% while Delhi’s Nehru Place recorded a decline of 8.5% y/y. Most of the major commercial hubs in Delhi and Mumbai, the two economic pillars of India, saw a decline in price rentals or very small growth.

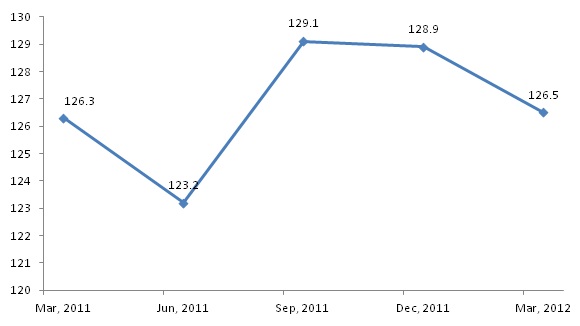

- The all India house transactions volume index released by Reserve Bank of India remained flat with a y/y change of 0.2% in March 2012. It declined by 1.9% on a q/q basis.

Chart: RBI house transactions volume index- All India (Mar 2009=100)

Source: CEIC Data

This is only a small extract of the insights in the India Property report; read more and purchase>>

Tags: Bangalore, commercial, Delhi, DLF, Hospitality, Housing, Housing and Urban Development Corporation (HUDCO), India, Inventory, Ministry of Housing and Urban Poverty Alleviation (MHUPA), Mumbai, National Housing Bank (NHB), Oberoi Realty, office, price, real estate, rental, Reserve Bank of India (RBI), residential, retail, sales, Sobha Developers, Vacant

Indonesia’s GDP grew by 6.5% in fiscal year 2011, its best performance in the last 15 years. This growth was driven by strong domestic consumption and investment. The Indonesian cement industry also witnessed a growth in capacity, consumption as well as production of cement: total revenues of the cement industry touched IDR 44 trillion in the year recording a y/y (year-on-year) growth of more than 17%. The industry accounted for 0.6% of the GDP in 2011.

The country was the second largest consumer amongst the Southeast Asian countries with total cement consumption reaching 48 million tons by years end. However, per-capita consumption was only 195kg, which was quite low compared to global and even regional standards. The annual cement production touched 52 million tons in FY11 while designed capacity grew to 57 million tons. Around 98% of cement produced in Indonesia was consumed by the domestic market itself during the year and the rest was exported.

Annual cement consumption recorded a growth of 17.7% in year 2011 backed by strong demand from the housing and construction sectors. To cash in on this rising demand, leading cement companies have charted out aggressive expansion plans. Semen Gresik has planned to invest IDR 6.96 trillion to develop cement plants in Java and Sumatra while Indocement has planned to invest IDR 1 trillion to develop two cement plants in Java. The third biggest producer, Holcim Indonesia has also planned to invest USD 200 million to develop a cement plant in Tuban, East Java. As a result of these expansions, the total designed capacity in the country is expected to touch 64 million tons by the end of year 2013.

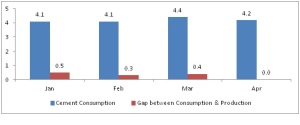

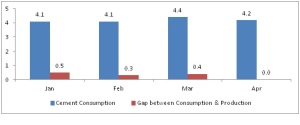

The first four months of FY12 also reflected a similar trend with growth in both consumption and production of cement. However, cement consumption was disproportional to cement production in this period, highlighting the huge demand for cement in the country. Cement consumption touched 16.8 million tons in the January-April period while production lagged behind at 15.6 million tons.

In FY11, Semen Gresik, Indocement and Holcim Indonesia together, accounted for 85% of the annual cement sales in the country. The other 15% came from Semen Andalas, Semen Baturaja and Semen Bosowa Marus. Semen Gresik continued to lead the industry by recording operating revenues of around IDR 16 trillion, a y/y growth of 12.7%. Holcim Indonesia recorded the highest EBIDTA growth of 28.4% y/y among the three players. Meanwhile, Indocement recorded a 24.7 y/y% growth in its total revenues which reached a figure of IDR 13.9 trillion.

The outlook for the Indonesian cement industry is positive. Backed by strong domestic demand and government support for housing and infrastructure development, the annual cement consumption is expected to cross 55 million tons by end of 2012 itself. The major challenges facing it are raising prices of fuel, coal, and transportation costs. The industry will also have to meet global pollution and emission standards which will take another considerable amount of investment.

Salient Points

- Indonesia’s cement industry recorded a 17.7% growth in domestic consumption in FY11. It also recorded consumption of 16.8 million tons in the first four months FY12 growing by 16.6% y/y. The annual consumption is expected to cross 55 million tons by the end of FY12.

- Total production of cement in Indonesia was around 52 million tons in FY11. In the first four months of fiscal year 2012, production of cement touched a figure of 15.6 million tons. The gap between consumption and production of cement during this period was 1.2 million ton.

- By the end of fy11, the total designed capacity for cement production in Indonesia was around 57 million tons. Semen Gresik was the leader in terms of designed capacity in FY11 with a share of around 35% of the total capacity. It was followed by Indocement and Holcim with a share of 33% and 14% respectively.

- In year 2011, the total export of cement from Indonesia was around 1.2 million tons. In the period 2007-11, cement exports declined at a CAGR of 37%. Around 98% of all cement produced in Indonesia was consumed by the domestic market itself in year 2011.

Chart: Total Cement Consumption in Indonesia-FY12 (In Million Tons)

Source: CEIC Data

These are only a few of the findings in the new Indonesia Cement Industry report. Learn more and purchase now>>

Tags: Aggregates, Capacity, Concrete, construction, Consumption, exports, GDP, Holcim Indonesia, Housing, imports, Indocement, Infrastructure., Island, Java, production, Semen Andalas, Semen Baturaja, Semen Bosowa Marus, Semen Gresik, SWOT analysis