Real estate sector has been one of the key drivers of Indian economic growth during the last decade. The housing sector of India ranks fourth in terms of multiplier effect on the economy. However in last few quarters, persistent inflation and high interest rates caused a dent in the growth of this sector. Affordability is a major concern for middle class Indians and a steady rise in housing prices together with high interest rates and inflation has neither helped their cause, nor has it benefited the real estate sector. As a result, experts are predicting a price correction in the housing sector of the country.

The sector showed some signs of recovery in the second half of 2012 with growth in number of transactions as well as improvement in absorption rates. However, the pessimistic growth and inflation figures witnessed in early 2013 again brought a slump in the market. A price correction took place in the commercial lease and rental segments of major cities. The slowdown in economic growth and vacant office spaces acted as catalysts in lowering rental prices of commercial properties in major hubs of the country. Residential prices, though, showed resilience and registered growth. The housing transaction volume index declined in the first three months; grew briskly in the next six and remained flat in the last three months in 2013. After a subdued first half of 2012, the index rose in the second half of 2012. BSE Reality Index, which represents the largest companies in the sector, rose in the second half of 2012 but witnessed a sharp decline in the first half of 2013.

The near term outlook for Indian property is negative because of low absorption, high interest rates and high inflation. Most of the leading real estate players are suffering from high debt levels and low profitability. However, looking at long term, the large supply/demand gap in the residential market and rising per capita income of Indians, along with increasing urbanization bodes well for this sector.

Key Findings

- In a report published by the Ministry of Housing and Urban Poverty Alleviation, it was estimated that at the start of 12th five year plan (2012-17) the total urban housing shortage in the country was around 18.78mn.

- According to Economic Survey of India 2012-13, the real estate sector accounted for around 10.8% of GDP as of FY12. The housing sector ranked fourth in terms of multiplier effect on the economy. During the period 2008-12, the sector grew at a CAGR of 11%.

- Between January 2000 and March 2013, real estate and construction development sector witnessed a cumulative FDI of USD 22bn. The sector accounted for 11% of the total cumulative FDI received during this period.

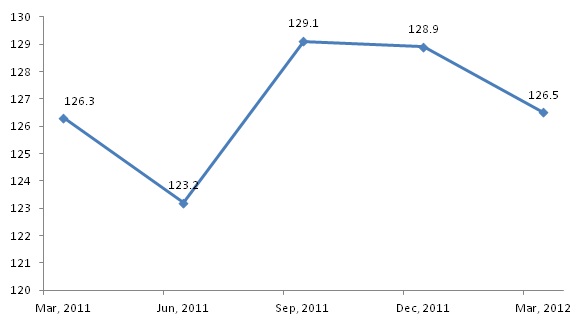

- The combined market capitalization of the companies listed on the BSE realty index was around USD 10bn as of August 20, 2013. After a subdued first half of 2012, the index rose in the second half of 2012. However, it again witnessed a sharp decline in the first half of 2013.

Source: BSE

Read more in EMD’s comprehensive report, India Property Industry>>