Indonesia has been active in the oil and gas industry for over 120 years after the country’s first oil discovery in North Sumatra back in 1885. The number of domestic exploration and production working areas in the upstream industry increased from 107 units in 2002 to 308 units by the end of 2012, as a result of industry investments of about USD 21.3bn in 2012.

Indonesia has become a net importer of oil largely due to maturing fields and rising local demand. In the first quarter of 2013, Indonesia incurred a deficit of USD 3.36bn in oil and gas trading. The country exported USD 8.15bn worth of oil and gas, but imported USD 11.51bn during the same period.

Indonesia had 0.2% of the world’s proven oil reserves at approximately 3.7bn barrels by the end of 2012. Natural gas reserves of the country stood at 2.9 trillion cubic meters in 2012, representing 1.6% of the world’s total reserves. In 2012, Indonesia produced approximately 2.1% of the global natural gas.

Key Findings

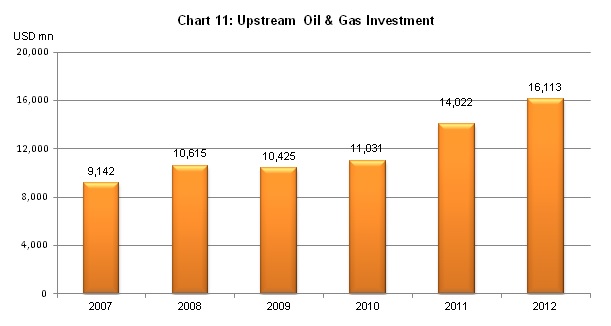

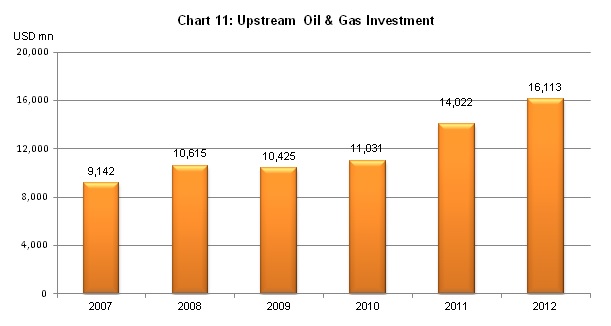

- In 2012, approximately USD 16.11bn was invested in the upstream oil and gas industry. Investment in production and development accounted for 64.36% and 20.41%, respectively.

- The number of domestic exploration and production working areas for the upstream industry increased from 107 in 2002 to 308 by the end of 2012.

- Indonesia has identified floating storage and regasification unit (FSRU) as a strategic asset to meet the country’s rising demand of gas.

- Indonesia aims to achieve 500 mmscfd of gas from coalbed methane by 2015 and 1,500 mmscfd by 2025.

Source: SKKMigas

Much more in the EMD report: Indonesia Oil & Gas Industry>>

Tags: BHPMigas, BPMigas, coalbed methane, Crude oil, daily production, downstream, Elnusa, Energi Mega, export, FSRU, gas, import, Indonesia, LNG regasification, Medco Energi, Ministry of Energy and Mineral Resources, Natural Gas, Nusantara Regas Satu, oil, PGN, PT Pertamina, PT Perusahaan Gas Negara Tbk, Radiant Utama, SKKMIGAS, upstream

Indonesia’s property industry has been booming in recent years with rising profits for property companies and property prices soaring throughout 2012. Despite the European debt crisis and global slowdown, Indonesia’s economy grew by 6.2%, continued to attract foreign direct investment. The country’s positive economic conditions and a growing middle-class have boosted domestic demand. This has increased developer confidence, leading to a jump property projects in Indonesia. Sales and rental rates have increased by an average of 10-20% during 2012.

The strong economy and improved investors’ sentiment have significantly increased demand for office space in Jakarta’s CBD area, which have shot up office rents and occupancy rate over 95% in 2012. Meanwhile, rising domestic consumption has encouraged retailers to expand their business, leading to higher occupancy levels and rental rates of retail space. The country’s improved tourism sector has also stimulated hotel development projects, ranging from 3-star to 5-star hotels.

Blessed with gains from the favorable economic conditions, property developers performed remarkably well in 2012 with new project launches and higher revenues. The sector is expected to remain firm in 2013 due to stable economic growth, controlled inflation and rising purchasing power. However, a risk to Indonesia’s property sector is the hike in the price of subsidized fuel which will result in a higher central bank interest rate, making it more expensive for Indonesians to buy a mortgage. Nonetheless, forecasters expect property prices to increase along with occupancy rates.

Key Findings

- Capitalising on the rapid economic growth and solid domestic demand, Jakarta’s CBD office market continued to expand with occupancy rates above 95% in Q1/2013.

- With conducive economic conditions and rising domestic demand, new apartment and retail projects are expected to enter the market in 2013. The average rental rates and occupancy rates are also expected to increase.

- Given the limited stock of industrial land, land prices have increased by 10.5% q/q alone in Q1/2013 with occupancy rates rising slightly to 65.9%.

- According to a survey by Bank Indonesia, housing prices in 14 major cities grew by 11% y/y and 4.8% q/q in Q1/2013 on the back of stable economic growth, controlled inflation and rising middle-income segment.

Source: Bank Indonesia’s Residential Property Survey

This is just a quick glimpse into the EMD Report: Indonesia Property Industry. Learn more now>>

Tags: apartments, BSDE, Bumi Serpong Damai, CBD, Ciputra Development, comparative matrix, condominium, credit, CTRA, hotel, houses, housing loan facilities, Indonesia, industrial, interest rates, leading players, Lippo Karawaci, LPKR, macroeconomic indicators, market outlook, occupancy rate, office, property, property financing, property price index, rental, residential, retail, selling price, SWOT analysis, vacancy rate

Indonesia’s GDP grew by a robust 6.2% in 2012, driven by strong domestic consumption and investment. The Indonesian cement industry also witnessed high growth in capacity, consumption as well as production of cement. The country is the second-largest consumer of cement in ASEAN, with total cement consumption of 55mn tonnes by year end. However, it still lags behind its peers in terms of per-capita consumption.

Total cement production reached 52mn tonnes in 2012 while designed capacity grew to 60mn tonnes. Annual cement consumption grew by 14.5% in 2012 backed by strong demand from the housing and construction sectors. To cash in on this rising demand, leading cement companies have charted out aggressive expansion plans. As such, the country’s total designed capacity is expected to increase to 80mn tonnes by 2015.

The first five months of FY13 also reflected a similar trend with growth in both consumption and production of cement. However, cement consumption was disproportional to cement production in this period, highlighting the huge demand for cement in the country. Cement consumption touched 22.9mn tonnes in the January-May period while production lagged behind at 21.8mn tonnes.

The industry is dominated by three players who represent over 85% of total cement sales: Semen Indonesia, Indocement and Holcim Indonesia. The outlook for the Indonesian cement industry is positive, attributed to strong economic prospects as well as low current consumption per capita.

Key Findings

- Indonesia’s domestic cement consumption grew by 14.5% to 55mn tonnes in 2012, making it the second-largest cement industry in the ASEAN region.

- Total designed capacity is expected to reach 80mn tonnes by 2015 in line with demand growth, up from the current 60mn tonnes.

- Total cement exports have declined significantly over the last few years owing to a surge in domestic demand. In 2012, total exports plunged 84%.

- Semen Indonesia is the leader in terms of sales, designed capacity and production. In 2012, the company had a 41% domestic market share based on sales volume. It was followed by Indocement and Holcim with a share of 32% and 15%, respectively.

Much more in the EMD report: Indonesia Cement Industry>>

Tags: ASEAN, bag, bulk, Capacity, cement, Concrete, construction, Consumption, exports, GDP, Holcim Indonesia, Housing, imports, Indocement, Indonesia, Infrastructure., islands, Java, Kalimantan, prices, production, sales, Semen Andalas, Semen Baturaja, Semen Bosowa Marus, Semen Indonesia, Sumatera, SWOT analysis

The textile and garment industry is an important contributor to Indonesia’s economy, serving as a large source for jobs and export earnings. Being the largest textiles and apparel producers in the region, it has a long tradition of producing and exporting ready-made garment and home- fashion textiles.

Exports of manufactured goods reached USD 22.63bn in 2012, a decrease of 11.19% year-on-year. The export value of textile yarns, fabrics, and made-up articles reached USD 4.55bn in 2012, down 5.02% from USD 4.79bn a year ago. Meanwhile, the textile, leather products and footwear sectors combined were the fourth largest contributor to the manufacturing industry with a market share of 9.81% for the quarter ending December 2012.

Textile companies across north Asia, especially from South Korea, Taiwan and China, have been making significant investments in Indonesia with the aim of exporting to their home country. These foreign entrants are anticipated to boost total investment in the textile industry to about IDR 6tr (USD 702mn), according to Ade Sudrajat, Chairman of the Indonesian Textile Association.

Salient Points

- The textile, leather products and footwear sectors combined were the fourth largest contributor to the manufacturing industry with a market share of 9.81% for the quarter ending December 2012.

- The export value of textile yarns, fabrics, and made-up articles reached USD 4.55bn in 2012, down 5.02% from USD 4.79bn a year ago.

- Imports of clothing registered a staggering growth of 47.88% year-on-year in 2012. The figures in 2012 were more than doubled the USD268.88mn recorded in 2009.

Souce: CEIC

This is just a quick glimpse into the EMD Report: Indonesia Textile & Garment Industry. Learn more and purchase now>>

Tags: apparel, article of apparel, clothing, CPI, development, economic indicators, employment, Eratex, Ever Shine, export, fabrics, financial highlights, garment, GDP, GNP, gross domestic product, gross national product, growth rate, import, Indonesia, Industrial Production, investment, IPI, machinery, made up articles, manufactured goods, manufacturing, Pan Brothers, performance, restructuring, SWOT, textile, textile articles, value, volume, yarns

Next to India and China, Indonesia represents one of the largest potential insurance markets in Asia. According to the Indonesian credit rating agency PEFINDO, life insurance coverage in Indonesia is still low at around 15% of the country’s population. Indonesia has seen steady growth in insurance premiums given the low penetration rate for insurance services, at merely 2% of GDP in 2011 as compared to over 4% in neighboring countries such as Singapore, Malaysia and Thailand. This has attracted many foreign investors to participate in the domestic insurance industry.

Indonesia’s solid economy is also fuelling growth for a developing insurance market, supported by rising domestic consumption, expanding government infrastructure spending and strengthening regulatory requirements. In line with these positive conditions, the life and non-life insurance sectors have seen steady growth in total assets and gross premiums over the years. Life insurance dominates the industry’s market share, accounting for 60% of total gross premiums in 2010.

As the country with the largest Muslim population in the world, Indonesia has a vast untapped sharia market. Fitch Ratings reported that gross premium of sharia insurance was less than 5% of total insurance market premiums in 2011. Industry analysts believe that the national sharia market will benefit from further growth due to the less established market and improved regulatory environment.

Key Findings

- The life insurance sector will continue to grow as the penetration rate is low, merely 2% of GDP, and life insurance coverage in Indonesia is still below 15% of the country’s population.

- Gross premiums for the life and non-life insurance sectors have continued to grow steadily over the years, reaching IDR 125tn in 2011 and contributing over 80% to total insurance industry premiums.

- The frequency of mergers and acquisitions (M&As) is set to increase, driven by the increased capital requirement, which may force local insurers having problems raising capital to joint venture with foreign partners.

These are only a few of the insights in the new EMD Report : Indonesia Insurance Industry 2H12. Learn more and purchase now>>

Tags: assets, civil service and armed forces insurance, density, foreign ownership, gross claims, gross premiums, Indonesia, insurance, insurance companies, investments, life insurance, net premium, non-life insurance, penetration, PT Asuransi Bina Dana Arta Tbk, PT Asuransi Multi Artha Guna Tbk, PT Panin Insurance Tbk, regulatory developments, reinsurance, retention rate, sharia market, size, social insurance, value

Indonesia has a fairly small but fast-growing pharmaceutical market, with an estimated value of USD 7.31bn in 2012. The pharmaceutical market is projected to grow at a compound annual growth rate of 10.8%, reaching a value of USD 12.2bn by 2017. It is expected that the market will further grow as current drug consumption per capital is relatively lower than neighbouring countries at about USD 20 in 2011, hence there likely will be increases in health spending in the future.

Due to a large population size and relatively strong production base, Indonesia has the potential to be a lucrative pharmaceutical and healthcare market. The country has a huge generic drugs sector, which is likely to see consolidation as larger companies seek to maximise profits through acquisition of smaller domestic companies. However, it is noteworthy that part of the generics market is made up of counterfeit drugs. Over-the-counter (OTC) segment has also shown steady growth in recent years, attributed to increased self-medication and accessibility to more affordable drugs.

Majority of the local pharmaceutical companies achieved better sales growth in 2011-12, supported by improved macro-economic conditions and stable raw material import prices. The leading players include PT Kalbe Farma Tbk, PT Merck Tbk, and PT Kimia Farma Tbk.

Salient Points

- Indonesia’s pharmaceutical market is projected to grow at a CAGR of 10.8% over the next five years, reaching USD 12.2bn by 2017, and will rank as the sixth largest pharmaceutical market in the Asia-Pacific region.

- According to industry estimates, drug expenditure is projected to reach IDR 84.8tn (USD 9.5bn) by 2016, with a CAGR of 10% during the 2011–2016 period.

- Healthcare spending in Indonesia, which is equivalent to 2.6% of GDP, is projected to nearly double over the next five years, driven by strong economic, demographic and income growth, as well as the eventual introduction of the national health insurance system by 2014.

Indonesia’s Projected Pharmaceutical Market, 2012–2017

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

| Market Value (USD billion) |

7.31

|

8.05

|

8.89

|

9.98

|

11.14

|

12.20

|

| % GDP |

0.8

|

0.8

|

0.7

|

0.7

|

0.7

|

0.7

|

| % Health Expenditure |

30.3

|

29.3

|

28.4

|

27.4

|

26.6

|

25.8

|

| Per Capita Expenditure (USD) |

29

|

32

|

35

|

39

|

43

|

47

|

Source: Espicom Business Intelligence

Much more in the EMD report: Indonesia Pharmaceutical Industry

Tags: Asia-Pacific, counterfeit drugs, drug consumption, drug patent, establishments, ethical drugs, exports, foreign support, generic drugs, health expenditure, healthcare, imports, Indonesia, industry SWOT, intellectual property rights, investments, Kalbe Farma, Kimia Farma, leading players, market outlook, medications, Merck, mergers and acquisitions, Ministry of Health, OTC medicines, People’s Pharmacy, performance, pharmaceutical, pharmaceutical companies, pharmaceutical raw materials, prescription drugs, production, regulations, sector size, value

The utilities industry consists of three main markets, electricity, gas and water. The electricity market proved to be the most lucrative utilities industry as it dominated 63.55% share of the market. Indonesia is the largest country in Southeast Asia; its main economic activity is agriculture, thus water utilities play an important role in agriculture production. Water consumption in the country is expected to increase to more than 356 billion cubic meters per annum by 2015.

Although water sources in Indonesia account for 21% of total water resources in Asia Pacific, lack of clean water is becoming a serious problem in Indonesia. Nearly half of the population in Indonesia lacks access to safe water and more than 70% of the 220 million person population rely on water sources that are deemed potentially contaminated. To achieve the Millennium Development Goals (MDGs), the Indonesian government needs to improve water supply and sanitation services.

For energy sources, PT Perusahaan Listrik Negara (PLN) has the sole right to produce and distribute electricity throughout Indonesia. The demand for electricity is projected to grow at more than 8% per year until 2020. Meanwhile, Indonesia has a proven natural gas reserve of 3.0 trillion cubic meters. Perusahaan Gas Negara (PGN) is the market leader in both transmission and distribution businesses in Indonesia.

Key Findings

- Demand for electricity in Indonesia is projected to grow at a pace of more than 8% per year until 2020.

- By the end of 2011, PLN had a total installed generation capacity of 29,268 MW, an increase of 8.8% over the previous year. Remarkably, the growth rate in 2011 was the highest it has been in the last five years.

- Indonesia plans to more than triple the share of new and renewable energy to the total national primary energy mix by 2025.

Electricity Supply in Indonesia

Source: CEIC

This is just a quick glimpse into the EMD Report: Indonesia Utilities Sector. Learn more and purchase now>>

Tags: biofuel, biomass, BIPI, BP Migas, business, ceramic, chemical, coal, commercial, Consumption, diesel, distribution, electricity, energy, gas, geothermal, household, hydro, Indika Energy, Indonesia, industrial, installed capacity, institution, IPP, laws and regulations, Natural Gas, outlook, PAM Lyonnaise Jaya, PGN, PLN, policies, power generation, power plant, prices, regulatory, renewable energy, reserves, resources, sanitation, solar power, steam, thermal, Transmission, utilities, wastewater, water, water access, WEPA, wind power

Indonesia’s steel consumption grew robustly by 22.4% y/y to 10.95mn metric tonnes in 2011 in line with the growth in domestic steel demand. As the country with the largest economy and highest population in ASEAN, its share of steel consumption reached 20.9% making it the top second steel consuming country in the region.

With about 300 domestic players, the steel industry of Indonesia employs more than 500,000 people and is capable of producing 5.5mn tonnes of total steel products annually including hot-rolled steel products (bars, wire rods and plates) and crude steel products (billet and slab). And more production is expected in the coming years.

Salient points

- The significant increase in Indonesia’s steel consumption in 2011 was supported more by import, which was 32% higher than the 2007 level, and not from domestic production.

- The country’s domestic steel production increased 4.5% y/y to 5.45mn tonnes in 2011. Bars and wire rods are the primary steel products and account for the largest annual production output of the industry.

- The gross domestic product (GDP) of the Indonesian iron and basic steel industry increased 3.4% y/y to IDR 8.0tn in Q2/2012.

Much more in the Emerging Markets Direct report: Indonesia Steel Industry 1H12

Tags: anti-dumping, apparent steel use, ASEAN, automobile, Bakrie and Brothers (BNBR), bars, Capacity, coking coal, cold-rolled, comparative matrix, construction, Consumption, contribution, crude steel, export, finished products, flat products, gross domestic product, Gunawan Dianjaya Steel (GDST), hot-rolled, import, Indonesia, Indonesian National Standard, investment, iron, iron ore, Jaya Pari Steel (JPRS), Krakatau Steel (KRAS), leading players, market outlook, performance, plates, policy, prices, production, raw materials, regulations, safeguards, sections, Steel, SWOT analysis, tariffs, trade, utilisation rate, wire rods

Consistent with Indonesia’s robust economic growth, the domestic banking industry continued to post significant gains in 2011. Total assets of banks in Indonesia stood at IDR 3,653tn as of December 2011, an increase of 21.4% y/y, while the asset quality remained strong over the same period. Total lending reached IDR 2,200tn in 2011, up 24.6% y/y. The increase occurred across all segments, both for working capital and consumption loans for both business and consumer lending.

On the funding side, total third party funds grew 19.1% y/y to IDR 2,785 in 2011, with increases in funding across all types of third party funds (savings, time and demand deposits). Faster paced growth in lending compared to that of funding resulted in a higher loan-to-deposit ratio (LDR) in 2011.

The overall performance of the Indonesian banking system improved in 2011, with banks achieving higher net interest margin (NIM) of 5.9% and industry’s profits rising to IDR 75tn. The banking industry’s capital also remained at a healthy level at 16.1% due to strong sector profitability.

The five leading banks in Indonesia recorded strong financial performance in 2011, thanks to favourable economic environment. Total loans were up with strong growth across all customer segments, while net income increased due to strong growth in lending and transaction accounts.

Key Findings

- Total third party funds increased across all types in 2011, with saving deposits recording the highest growth rate of 22.5% y/y, followed by demand deposits (21.8%) and time deposits (15.3%).

- The industry’s net profits reached IDR 75tn in 2011, up 31.6% from IDR 57tn in 2010 with strong growth in NIM and loan portfolio.

Indonesian Banking Sector Highlights (IDR tn)

Source: Bank of Indonesia

These are only a few of the findings in the new Indonesia Banking Industry report. Learn more and purchase now>>

Tags: Bank Mandiri (BMRI) Bank Rakyat Indonesia (BBRI) Bank Central Asia (BBCA) Bank Negara Indonesia (BBNI) Bank Danamon Indonesia (BDMN), banking, capital adequacy ratio, comparative matrix, financial highlights, Indonesia, interest rates, Islamic banking, loan-to-deposit ratio, micro small medium enterprises, net interest income, net interest margin, non-performing loans, profit, return on assets, return on equity, rural banks, size, SWOT analysis, total assets, total credits, total deposits, total loans, value

The industry plays an important part of Indonesia’s economy as a large source of jobs and export earnings. Bank of Indonesia reduced its policy rate by 25 basis points to 5.75% in February 2012 to boost economic growth. Indonesian textile and garment industry is integrated in almost every phase of production. The country happens to be one of the largest textiles and apparel producer in the region, although now it is not as competitive as it used to be with its rival in Asia-Pacific due to the conditions of factory machinery, high electricity prices, ASEAN free-trade agreement with China, global economic slowdown, and the crisis in Europe. As new export data across Asia shows some softening in demand for Asian products. Moreover, financial markets remain nervous.

All said and done, even as businesses enjoy strong domestic growth and Asia, they must be prepared for a volatile and difficulty year ahead.

Salient Points

- Indonesia’s textile growth propelled by domestic demand as global textile and garment market remain subdued next year.

- More Chinese firms invest in Indonesian textile industry in particular West Java. China has committed 234 textile projects worth USD 473mn according to The Ministry of Trade and Industry.

- Budget allocation for textile machine upgradation slash by 4.6 percent from IDR 152.5billion in 2011 to IDR 145.5 in current year.

- China dominates Indonesia textile imports accounting for 60 percent of total imports according to Indonesian Textile Businesses (API)

This is only a small portion of the insight provided in the Indonesia Textile and Garment Industry report . Read more and purchase>>

Tags: Badan Pusat Statistik Republik Indonesia, Economic Forecast, ERTX.:JK; PT Ever Shine Tex Tbk (Evershine), ERTX:IJ, ESTI.JK, ESTI:IJ, fabrics and textiles, Indonesia, Indonesia Industrial Production, Industrial Production, IP, IP growth rate, Macro Economic Indicators, Manufacture and export of yarn, Manufacturing textiles, PBRX.JK, PBRX:IJ, PT Eratex Djaja Tbk (Eratex), PT Pan Brothers Tbk (Pan Brothers), Textile Industry SWOT