Indonesia’s property industry has been booming in recent years with rising profits for property companies and property prices soaring throughout 2012. Despite the European debt crisis and global slowdown, Indonesia’s economy grew by 6.2%, continued to attract foreign direct investment. The country’s positive economic conditions and a growing middle-class have boosted domestic demand. This has increased developer confidence, leading to a jump property projects in Indonesia. Sales and rental rates have increased by an average of 10-20% during 2012.

The strong economy and improved investors’ sentiment have significantly increased demand for office space in Jakarta’s CBD area, which have shot up office rents and occupancy rate over 95% in 2012. Meanwhile, rising domestic consumption has encouraged retailers to expand their business, leading to higher occupancy levels and rental rates of retail space. The country’s improved tourism sector has also stimulated hotel development projects, ranging from 3-star to 5-star hotels.

Blessed with gains from the favorable economic conditions, property developers performed remarkably well in 2012 with new project launches and higher revenues. The sector is expected to remain firm in 2013 due to stable economic growth, controlled inflation and rising purchasing power. However, a risk to Indonesia’s property sector is the hike in the price of subsidized fuel which will result in a higher central bank interest rate, making it more expensive for Indonesians to buy a mortgage. Nonetheless, forecasters expect property prices to increase along with occupancy rates.

Key Findings

- Capitalising on the rapid economic growth and solid domestic demand, Jakarta’s CBD office market continued to expand with occupancy rates above 95% in Q1/2013.

- With conducive economic conditions and rising domestic demand, new apartment and retail projects are expected to enter the market in 2013. The average rental rates and occupancy rates are also expected to increase.

- Given the limited stock of industrial land, land prices have increased by 10.5% q/q alone in Q1/2013 with occupancy rates rising slightly to 65.9%.

- According to a survey by Bank Indonesia, housing prices in 14 major cities grew by 11% y/y and 4.8% q/q in Q1/2013 on the back of stable economic growth, controlled inflation and rising middle-income segment.

Source: Bank Indonesia’s Residential Property Survey

This is just a quick glimpse into the EMD Report: Indonesia Property Industry. Learn more now>>

Tags: apartments, BSDE, Bumi Serpong Damai, CBD, Ciputra Development, comparative matrix, condominium, credit, CTRA, hotel, houses, housing loan facilities, Indonesia, industrial, interest rates, leading players, Lippo Karawaci, LPKR, macroeconomic indicators, market outlook, occupancy rate, office, property, property financing, property price index, rental, residential, retail, selling price, SWOT analysis, vacancy rate

Commercial property investments in Romania surged by 32% in 2011 – C&W.

Investments in commercial property in Romania surged by 32% y/y to USD 425mn in 2011, according to data from Cushman & Wakefield. Investment activity in 2012 is expected to increase further. The prime yield in the office and retail property sector stood at 9% and at 9.5% in the industrial property sector last year

Commercial property investments in Serbia plunge 38.1% in 2011 – C&W.

Investments in commercial property in Serbia plunged by 38.1% y/y to USD 88mn in 2011, according to data from Cushman & Wakefield. Investment activity in 2012 is expected to stay as in 2011.

Commercial property investments in Croatia down 13.6% in 2011 – C&W.

Investments in commercial property in Croatia fell by 13.6% y/y to USD 289mn in 2011, according to data from Cushman & Wakefield. Investment activity in 2012 is expected to stay the same as in 2011. The prime yield in the office sector was 8%, the retail sector stood at 7.75% and the industrial property sector at 9.50%.

Investments in commercial property in Bulgaria skyrocketed 916.34% y/y to USD 257mn in 2011, according to data from C&W. Investment activity in 2012 is projected to remain flat. The prime yield in the office and retail property sector stood at 11% and at 9.5%; in the industrial property sector at 12% and the outlook for 2012 hints growth.

Romania was the largest market for new commercial property investments in SEE, according to the Cushman & Wakefield report International Investment Atlas Summary 2012. The other SEE countries for which data was available were Bulgaria, Croatia and Serbia. Commercial property investments in Romania totalled USD 425mn in 2011, which was 32% more than in 2010. Croatia ranked second although it had dropped compared to 2010. The third biggest market, Bulgaria, registered a 916.3% growth, the highest among all countries included in the report. Serbia was the region’s least attractive market with investments plunging by 38.1%.

These are only a few of the insights in the new Intellinews Report : SEE Construction and Real Estate Report. Learn more and purchase now>>

Tags: ADF, Albania, apartments, Azvi, Bosnia Herzegovina, bridge, building, Bulgaria, business, completed housing, construction, cost, Croatia, demand, GDP, growth, HAC, investment, loan, Macedonia, market, Moldova, Montenegro, motorway, office supplies, Orascom, permits, price, property, railway, real estate, Romania, sales, Serbia, Slovenia, supply, Tirana

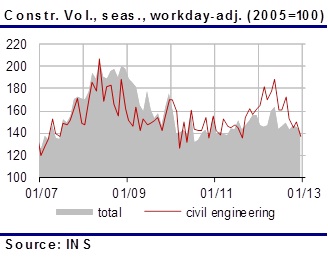

The construction works volume index shrank by 0.2% y/y in 2012, turning negative area after the 2.8% y/y growth in 2011. The construction works dynamics recorded encouraging performance in H1, but the activity in the sector weakened abruptly in the second half of the year, affected by the political turmoil in Jul-Aug and further by the government’s decision to cut public funding for infrastructure in the autumn budget adjustment.

The real estate market appear to have stabilised at low levels in 2012. The value of real estate transactions inched up by approximately 6.3% y/y last year, but the total remains below EUR 1bn annual average in the pre-crisis years. Investors and developers maintain cautious as most projects are currently financed through their own resources, yet the retail segment remains dynamic and new schemes continue to emerge.

Learn more from our Intellinews report: Romania Construction and Real Estate Sector

Tags: AFI Europe, apartments, Astaldi, Belgian Mitiska Ventures, Carrefour, CNADNR, construction, cost, Delta ACM, Dutch Van Oord, financial, government, Immochan, Infrastructure., investments, investor, Italo-Romena bank, NEPI, offices, prices, public roads, Public Roads Company, real estate, residential property, retail stock, Romania, Spanish Graells&Llonch, Swedish Skanska, Transilvania Constructii, transport ministry

Construction activity contracted in most counties in Southeast Europe in the first half of 2012, continuing a trend from 2011 as the ongoing instability in the eurozone, the major market for the region’s exports, is forcing developers to delay new construction projects. The outlook for the sector remains gloomy as the sovereign debt crisis in the eurozone is denting demand for eastern European exports, leading to a fall in investments. Increased public spending on infrastructure last year helped the construction sector somewhat offset the decline of commercial and residential building activity but funds for large infrastructure projects this year have been cut, following government’s efforts to reduce fiscal deficits by scaling down expenses.

Construction activity in most SEE countries, for which data is available, declined in the first half of 2012, continuing a trend from 2011. The only gainers were Romania and Serbia.

Construction output in EU27 down 6% in Q2 2012

Data from Eurostat showed that construction output in the European Union countries decreased by 6% y/y and by 1.2% q/q in the second quarter of 2012. Of the three EU member states included in this report, Slovenia and Bulgaria witnessed a drop in construction output, while production in Romania grew at its fastest annual rate in more than a year.

Investments in retail property dominated the real estate market this year with almost all SEE countries adding new shopping centre space.

Activity on the office property market remained strong with most of the SEE countries adding new space. Expectations this year are for stagnation in Albania and growth in Bulgaria, Croatia and Romania. Regarding the residential property market, home prices increased in Albania, Bosnia, Croatia and Slovenia but fell in Bulgaria, Macedonia, Moldova, Montenegro, Romania and Serbia.

Sofia was the leader among SEE capitals adding 77,000 sq m of new office space in the first half of 2012, data from real estate consultancy Colliers International showed. Bucharest and Belgrade followed, each adding 40,000 sq m to their office stock in H1.

This is only a small extract of the insights in the SEE Construction and Real Estate report; read more and purchase>>

This is only a small extract of the insights in the SEE Construction and Real Estate report; read more and purchase>>

Tags: Albania, apartments, AzVirt, Bosnia Herzegovina, bridge, building, Bulgaria, business, CoE Development Bank, completed housing, construction, Copisa, cost, Croatia, demand, GDP, growth, HAC, Hrvatske, IGH, investment, loan, Lustica Development, Macedonia, market, Moldova, Montenegro, motorway, office supplies, permits, price, property, railway, real estate, Romania, sales, Serbia, Skanska, Slovenia, Strabag, supply

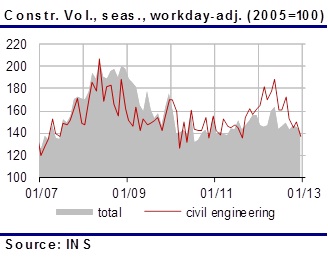

Construction works volume index grew by 9.1% y/y in Q2 and by 6.8% y/y in H1/2012, according to official statistics. The works for engineering projects surged by 17.1% y/y in Q2 and 18.1% y/y in H1, remaining the sector’s growth driver. Nonetheless, the construction works volume dropped by 4.6% y/y in July, losing ground immediately after the June 10 local elections had driven up the index in Q2. The construction sector’s dynamics and its contribution to the GDP growth are likely to witness abrupt weakening in H2, as the government cut down significantly public funding for infrastructure under the autumn budget adjustment and construction works on large projects, such as motorways and Bucharest underground sections had to be slowed down.

Figure 1 Construction works index in 2007-2012 (2005=100)

These are only a few of the insights in the new IntelliNews : Romania Construction and Real Estate Report. Learn more and purchase now>>

Tags: apartments, Astaldi, Carrefour, Consortium, construction, cost, financial, government, Infrastructure., investments, investor, NEPI, offices, prices, public roads, real estate, residential property, retail stock, Romania, Somet SA, TIAB SA, transport ministry