Commercial property investments in Romania surged by 32% in 2011 – C&W.

Investments in commercial property in Romania surged by 32% y/y to USD 425mn in 2011, according to data from Cushman & Wakefield. Investment activity in 2012 is expected to increase further. The prime yield in the office and retail property sector stood at 9% and at 9.5% in the industrial property sector last year

Commercial property investments in Serbia plunge 38.1% in 2011 – C&W.

Investments in commercial property in Serbia plunged by 38.1% y/y to USD 88mn in 2011, according to data from Cushman & Wakefield. Investment activity in 2012 is expected to stay as in 2011.

Commercial property investments in Croatia down 13.6% in 2011 – C&W.

Investments in commercial property in Croatia fell by 13.6% y/y to USD 289mn in 2011, according to data from Cushman & Wakefield. Investment activity in 2012 is expected to stay the same as in 2011. The prime yield in the office sector was 8%, the retail sector stood at 7.75% and the industrial property sector at 9.50%.

Investments in commercial property in Bulgaria skyrocketed 916.34% y/y to USD 257mn in 2011, according to data from C&W. Investment activity in 2012 is projected to remain flat. The prime yield in the office and retail property sector stood at 11% and at 9.5%; in the industrial property sector at 12% and the outlook for 2012 hints growth.

Romania was the largest market for new commercial property investments in SEE, according to the Cushman & Wakefield report International Investment Atlas Summary 2012. The other SEE countries for which data was available were Bulgaria, Croatia and Serbia. Commercial property investments in Romania totalled USD 425mn in 2011, which was 32% more than in 2010. Croatia ranked second although it had dropped compared to 2010. The third biggest market, Bulgaria, registered a 916.3% growth, the highest among all countries included in the report. Serbia was the region’s least attractive market with investments plunging by 38.1%.

These are only a few of the insights in the new Intellinews Report : SEE Construction and Real Estate Report. Learn more and purchase now>>

Tags: ADF, Albania, apartments, Azvi, Bosnia Herzegovina, bridge, building, Bulgaria, business, completed housing, construction, cost, Croatia, demand, GDP, growth, HAC, investment, loan, Macedonia, market, Moldova, Montenegro, motorway, office supplies, Orascom, permits, price, property, railway, real estate, Romania, sales, Serbia, Slovenia, supply, Tirana

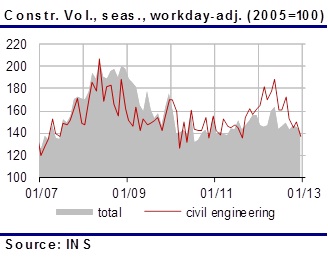

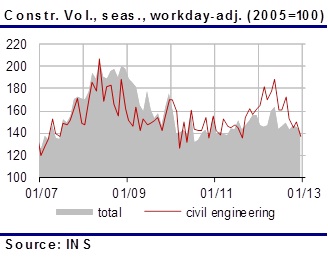

The construction works volume index shrank by 0.2% y/y in 2012, turning negative area after the 2.8% y/y growth in 2011. The construction works dynamics recorded encouraging performance in H1, but the activity in the sector weakened abruptly in the second half of the year, affected by the political turmoil in Jul-Aug and further by the government’s decision to cut public funding for infrastructure in the autumn budget adjustment.

The real estate market appear to have stabilised at low levels in 2012. The value of real estate transactions inched up by approximately 6.3% y/y last year, but the total remains below EUR 1bn annual average in the pre-crisis years. Investors and developers maintain cautious as most projects are currently financed through their own resources, yet the retail segment remains dynamic and new schemes continue to emerge.

Learn more from our Intellinews report: Romania Construction and Real Estate Sector

Tags: AFI Europe, apartments, Astaldi, Belgian Mitiska Ventures, Carrefour, CNADNR, construction, cost, Delta ACM, Dutch Van Oord, financial, government, Immochan, Infrastructure., investments, investor, Italo-Romena bank, NEPI, offices, prices, public roads, Public Roads Company, real estate, residential property, retail stock, Romania, Spanish Graells&Llonch, Swedish Skanska, Transilvania Constructii, transport ministry

SG Healthcare provides an overview of the healthcare industry in Singapore and the Asia Pacific. Singapore’s healthcare system is internationally recognized and was ranked 6th out of 191 countries and 1st in Asia in the World Health Report on health systems, hence allowing the country to be well poised to benefit from global trends. In 2011, Singapore’s healthcare services industry had more than 4,300 establishments with about 69,000 employees working in the industry.

The report includes the market trends and outlook of the healthcare industry in Singapore. We examine the financing approach of Singapore’s healthcare industry, medical tourism as well as other initiatives undertaken by the government to improve its healthcare industry. According to the Singapore Tourism Board, Singapore earned SGD 940 million from medical tourism in 2010, a whopping SGD 200 million increase from a year ago.

Also, the report encompasses the profile of leading players in the healthcare industry as well as their respective financial highlights. Among the leading healthcare players in Singapore are Parkway Pantai Limited, Thomson Medical Centre Limited, Health Management International Limited and China Healthcare Limited. Parkway is the largest healthcare provider in Singapore and one of the largest in Asia.

Key Findings:

- In 2011, Singapore’s healthcare services industry had more than 4,300 establishments with about 69,000 employees working in the industry.

- According to the Singapore Tourism Board, Singapore earned SGD 940 million from medical tourism in 2010, a whopping SGD 200 million increase from a year ago.

- Going forward, Asia and Latin America are projected to lead the growth in the global pharmaceutical industry.

Chart 3: Social Development in Healthcare Industry

Source: Department of Statistics

Learn more from our EMD report: Singapore Healthcare Industry 2H12

Tags: 3M, acute care, admissions, Asia-Pacific, attendances, bill size, CCI, China Healthcare, clinics, cost, day surgeries, dental, economy, EDB, eldershield, establishments, extended care, financing, GDP, Gleneagles, gynecology, Hanh Phuc Hospital, healthcare, healthcare services, healthcare workers, HMI, Hospital, HPB, IHH, inflation rate, inpatient, JCI, life expectancy, market size, medical centre, medical specialties, Medical Tourism, medical treatment, medicine, medifund, medisave, medishield, MOH, Mount Elizabeth, NEHR, net profit, non-western, obstetrics, outpatient, Pantai, pharmaceutical, polyclinics, population, private, privatisation, public, purchasing power, revenue, Singapore, SingaporeMedicine, social development, SPBA, Thomson, TMC, western

Construction activity contracted in most counties in Southeast Europe in the first half of 2012, continuing a trend from 2011 as the ongoing instability in the eurozone, the major market for the region’s exports, is forcing developers to delay new construction projects. The outlook for the sector remains gloomy as the sovereign debt crisis in the eurozone is denting demand for eastern European exports, leading to a fall in investments. Increased public spending on infrastructure last year helped the construction sector somewhat offset the decline of commercial and residential building activity but funds for large infrastructure projects this year have been cut, following government’s efforts to reduce fiscal deficits by scaling down expenses.

Construction activity in most SEE countries, for which data is available, declined in the first half of 2012, continuing a trend from 2011. The only gainers were Romania and Serbia.

Construction output in EU27 down 6% in Q2 2012

Data from Eurostat showed that construction output in the European Union countries decreased by 6% y/y and by 1.2% q/q in the second quarter of 2012. Of the three EU member states included in this report, Slovenia and Bulgaria witnessed a drop in construction output, while production in Romania grew at its fastest annual rate in more than a year.

Investments in retail property dominated the real estate market this year with almost all SEE countries adding new shopping centre space.

Activity on the office property market remained strong with most of the SEE countries adding new space. Expectations this year are for stagnation in Albania and growth in Bulgaria, Croatia and Romania. Regarding the residential property market, home prices increased in Albania, Bosnia, Croatia and Slovenia but fell in Bulgaria, Macedonia, Moldova, Montenegro, Romania and Serbia.

Sofia was the leader among SEE capitals adding 77,000 sq m of new office space in the first half of 2012, data from real estate consultancy Colliers International showed. Bucharest and Belgrade followed, each adding 40,000 sq m to their office stock in H1.

This is only a small extract of the insights in the SEE Construction and Real Estate report; read more and purchase>>

This is only a small extract of the insights in the SEE Construction and Real Estate report; read more and purchase>>

Tags: Albania, apartments, AzVirt, Bosnia Herzegovina, bridge, building, Bulgaria, business, CoE Development Bank, completed housing, construction, Copisa, cost, Croatia, demand, GDP, growth, HAC, Hrvatske, IGH, investment, loan, Lustica Development, Macedonia, market, Moldova, Montenegro, motorway, office supplies, permits, price, property, railway, real estate, Romania, sales, Serbia, Skanska, Slovenia, Strabag, supply

Construction works volume index grew by 9.1% y/y in Q2 and by 6.8% y/y in H1/2012, according to official statistics. The works for engineering projects surged by 17.1% y/y in Q2 and 18.1% y/y in H1, remaining the sector’s growth driver. Nonetheless, the construction works volume dropped by 4.6% y/y in July, losing ground immediately after the June 10 local elections had driven up the index in Q2. The construction sector’s dynamics and its contribution to the GDP growth are likely to witness abrupt weakening in H2, as the government cut down significantly public funding for infrastructure under the autumn budget adjustment and construction works on large projects, such as motorways and Bucharest underground sections had to be slowed down.

Figure 1 Construction works index in 2007-2012 (2005=100)

These are only a few of the insights in the new IntelliNews : Romania Construction and Real Estate Report. Learn more and purchase now>>

Tags: apartments, Astaldi, Carrefour, Consortium, construction, cost, financial, government, Infrastructure., investments, investor, NEPI, offices, prices, public roads, real estate, residential property, retail stock, Romania, Somet SA, TIAB SA, transport ministry

Ukraine seems interested in developing own shale gas resources as a diversification from predominant Russian imports, but the business climate in the country looks problematic. The state is very interested in energy projects; however investors are cautious of moving into Ukraine’s energy business at the moment, as this often meant joining up or competing with state-based organizations, or groups that could be linked to state officials or their relatives.

Ukraine has significant shale oil gas reserves, according to the existing estimates, equal to those of Sweden and roughly one quarter of the reserves of the major reserve holders Poland and France. OECD/IEA indicates roughly 1,100bn m3 of gas reserves. Wood Mackenzie however indicates that the Lublin basin, in Poland, could have reserves in excess of 1,400bn m3 and have equal reserves in the Ukrainian portion of the basin.

Main shale gas basins in Ukraine [Source: Advanced Resources International, IntelliNews]

With Europe’s fourth largest shale gas reserves according to the OECD/IEA, and hopes for even more as supported by prognoses like those put forth Wood Mackenzie and others, the production stakes in Ukraine have aroused international interest. Exploration on the Ukrainian side of the border so far has been narrow however. This is largely the purview of internationals. TNK-BP, Gazprom and Shell are looking at Ukrainian exploration. There are also several junior explorers, such as Eurogas, actively exploring in Ukraine.

This is only a small extract of the insights in the IntelliNews Special Report, Ukraine Shale Gas Sector; read more and purchase>>

Tags: Balchem, Cadogan, Chevron, cost, development, East Europe, economy, Eni, export, Exxon Mobil, frackling technology, Gasfrac Energy Services, Gazprom, government, hydraulic, import, investors, KUB-Gas, Natural Gas, OMV, OMV Petrom, politics, price, production, profits, risk, Russia, shale gas, Shell, size, Svenska Capital, technologies, TNK-BP, TPAO, Trican Well, Ukraine

Poland is in the front line of Europe’s shale gas operations. According to the Environment Ministry’s data, 18 research drillings were successfully conducted and 14 another were under preparation. Still these drills are not enough to reasonably assess the actual potential for commercial use of shale gas. Even if the existence of gas is confirmed, it does not necessarily mean that there is potential for commercial use. From the tests made so far, the only concession, which may hold a satisfying amount of gas is PGNiG’s Wejherowo concession in Lubocin.

Apart from uncertain resources, experts mention several other potential barriers, which may increase the risk for shale gas investors in Poland and may even make such investments unreasonable:

- Protectionism of local service sector especially regarding drilling firms

- Restrictions to foreign drilling firms to enter the Polish market (for example a requirement to operators of drilling equipment to have local permissions)

- Long lasting procedures for importing the drilling equipment from outside the EU

- The necessity to announce tenders for drilling operations;

- Uncertainty concerning the price of gas on the regulated market;

- Complicated regulation concerning access to geological information and high price of such information;

- Changing and unclear regulation regarding the environment protection.

This is only a short extract from all the insights provided in the IntelliNews Special Report, Poland Shale Gas Sector; read more and purchase>>

Tags: 3 Legs resources, Balchem, Bulgaria, Chevron, cost, development, East Europe, economy, Eni, export, Exxon Mobil, frackling technology, Gasfrac Energy Services, Gazprom, government, hydraulic, import, investors, KGHM, Lotos, Marathon Oil corporation, Natural Gas, OMV, OMV Petrom, Petrolinvest, PGNiG, PKN Orlen, Poland, politics, price, production, profits, risk, Romania, San Leon Energy, shale gas, Shell, size, technologies, TNK-BP, TPAO, Trican Well, Turkey, Ukraine

In the US, 12 years after the start of significant operation, shale gas flows reached some 170bn m3. The real impact was visible in the second half of the cycle, when supplementary non-conventional gas pushed exports and consumption up and imports down.

Will this be the case in Europe? Our findings point to the fact that even if certain areas of the continent (Eastern Europe particularly) are strongly interested in grasping this opportunity, a would-be shale boom in Europe reach neither the magnitude nor the speed of development seen in the US.

Europe will rather seek to diversify its external gas resources by building LNG terminals or investing in pipeline to gas rich regions. Actually, the shale gas at global level will not reach the magnitude seen in the US recently, as suggested by the consensus projections.

More detail, including extensive analysis of markets, technologies, political landscape and specific businesses, in the IntelliNews special report, East Europe Shale Gas Sector; read more and purchase>>

Tags: Balchem, Bulgaria, Chevron, cost, development, East Europe, economy, Eni, export, Exxon Mobil, frackling technology, Gasfrac Energy Services, Gazprom, government, hydraulic, import, investors, Natural Gas, OMV, OMV Petrom, Poland, politics, price, production, profits, risk, Romania, shale gas, Shell, size, technologies, TNK-BP, TPAO, Trican Well, Turkey, Ukraine