Under the 10th Malaysia Plan (2011–2015), the government has identified healthcare services as one of the 12 National Key Economic Areas (NKEA) to generate revenue for the country. Malaysia now has 8 Joint Commission International (JCI) and 24 Malaysia Society for Quality in Health (MSQH) accredited hospitals, with another 31 hospitals and ambulatory care facilities in the process of becoming accredited.

Market drivers such as rising middle and affluent income population, medical tourism, rise in chronic disease and aging and growing population will impact the healthcare services market, according to Frost & Sullivan. Conversely, market constrains such as medical personnel shortage, discrepancy between urban and rural regions and the inability to meet the demand of healthcare services in towns and rural areas will set the market back.

According to the World Bank health statistics, Malaysia’s spending on healthcare was estimated at 4.4% of its GDP, with government expenditure accounting for 55% of total health expenditure. Private sector services mainly dominate the healthcare industry in Malaysia. Frost & Sullivan estimated the private healthcare sector to generate revenue of MYR 11bn in 2018 from MYR 7bn in 2012, growing at a CAGR of 8.4% during 2012–2018.

Besides, Malaysia is fast becoming the destination of choice for medical tourists behind Thailand and Singapore, driven by affordable costs, specialised hospitals, high-quality medical care and short waiting times. According to the Malaysian Healthcare Travel Council (MHTC), the number of foreign patients seeking medical treatment in Malaysia would expand from the current 600,000 in 2012 to 2 million by 2020.

KPJ Healthcare Berhad is the largest private healthcare operator in the country with more than 2,600 beds across its hospitals or about 21% of the total private sector capacity. The group also has the highest share of patient admissions and the largest number of medical personnel.

Salient points

- With rapid population growth and rising per capita incomes, Frost & Sullivan predicted Malaysia’s private healthcare sector to expand from MYR 7bn in 2012 to MYR 11bn in 2018, growing at a CAGR of 8.4% during the period.

- Despite low spending on healthcare at 4.4% of its GDP, Malaysia had the second-highest health expenditure per capita in the ASEAN region in 2012 at USD 518.

- According to the MHTC, around 600,000 foreign patients seek medical treatment in Malaysia, generating revenue of nearly MYR 550mn in 2012. Indonesian patients remain as one of its major source, representing about 50% of the revenue and 70% of the arrivals.

Sources: MHTC; APHM

Read more in EMD’s comprehensive report, Malaysia Healthcare Industry>>

Tags: accreditations, Faber Group Berhad, growth opportunities, health budget, health expenditure, health insurance, health tourism, healthcare, human resource, incentives, KPJ Healthcare Berhad, leading players, Malaysia, market trends, medical tourists, outpatient, pharmaceutical, private sector, public sector, reforms, services, size, SWOT, TMC Life Sciences Berhad, treatment costs, value

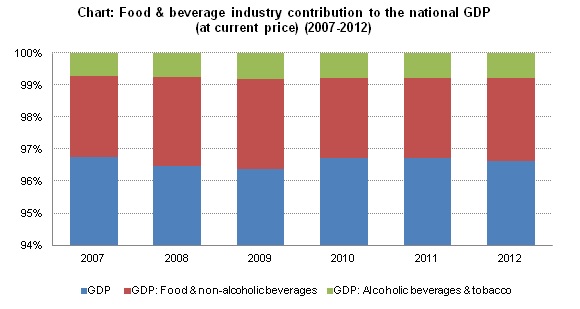

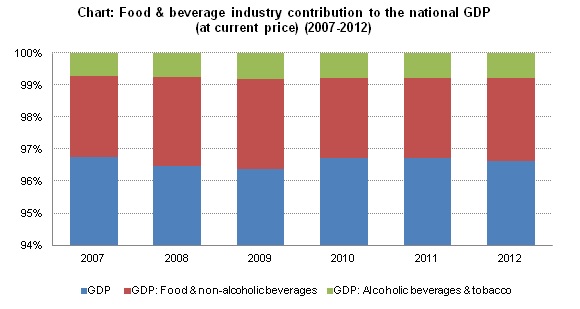

Singapore’s food and beverage (F&B) services industry contributed approximately SGD 11.98bn or 3.5% to the country’s total GDP in 2012. On a per capita basis, Singapore has the highest food consumption levels in Southeast Asia, accounting for 3% of GDP. Due to limited domestic agricultural production and rapid urbanisation, the country imports more than 90% of its food products, particularly from other Asian countries. Imports of F&B account for over 8% of GDP in 2012.

Expenditure on F&B has grown steadily in Singapore, with market value expanding from around SGD 9bn in 2007 to SGD 12bn in 2012. The rise in the number of working women, growing middle class population and the surge in disposable income were the main drivers of this growth.

Going forward, the country’s F&B industry is expected to witness robust growth thanks to highly promising per capita consumption growth. Food retail, which currently represents 40% of the total retail spending in Singapore, is expected to increase due to higher incomes and rising visitor arrivals.

Key findings

- Singapore’s F&B industry contributed around SGD 12bn or 3.5% to the country’s total GDP in 2012. The rise in the number of working women, growing middle class population and the surge in disposable income have contributed to the expanding F&B market.

- On a per capita basis, Singapore has the highest food consumption levels in the Southeast Asia region. The country’s food consumption was estimated to reach USD 7.7bn in 2012, accounting for 3% of GDP.

- Restaurants contributed a significant 36% of the total 6,500 establishments in the F&B industry in 2010. They were the largest employer, employing some 37,500 workers or an average of 16 workers per establishment.

This is just a quick glimpse into the EMD Report: Singapore Food & Beverage Industry

Tags: APB, beverage, comparative matrix, consumer preferences, Consumption, CPI, establishments, expansion strategies, expenditure, export, F&N, food, Food Empire, health food, IIP, import, leading players, manpower, manufacturing, market value, OLAM, operating receipts, Petra Foods, prices, regulations, retail, services, Singapore, size, standards, trends

Next to India and China, Indonesia represents one of the largest potential insurance markets in Asia. According to the Indonesian credit rating agency PEFINDO, life insurance coverage in Indonesia is still low at around 15% of the country’s population. Indonesia has seen steady growth in insurance premiums given the low penetration rate for insurance services, at merely 2% of GDP in 2011 as compared to over 4% in neighboring countries such as Singapore, Malaysia and Thailand. This has attracted many foreign investors to participate in the domestic insurance industry.

Indonesia’s solid economy is also fuelling growth for a developing insurance market, supported by rising domestic consumption, expanding government infrastructure spending and strengthening regulatory requirements. In line with these positive conditions, the life and non-life insurance sectors have seen steady growth in total assets and gross premiums over the years. Life insurance dominates the industry’s market share, accounting for 60% of total gross premiums in 2010.

As the country with the largest Muslim population in the world, Indonesia has a vast untapped sharia market. Fitch Ratings reported that gross premium of sharia insurance was less than 5% of total insurance market premiums in 2011. Industry analysts believe that the national sharia market will benefit from further growth due to the less established market and improved regulatory environment.

Key Findings

- The life insurance sector will continue to grow as the penetration rate is low, merely 2% of GDP, and life insurance coverage in Indonesia is still below 15% of the country’s population.

- Gross premiums for the life and non-life insurance sectors have continued to grow steadily over the years, reaching IDR 125tn in 2011 and contributing over 80% to total insurance industry premiums.

- The frequency of mergers and acquisitions (M&As) is set to increase, driven by the increased capital requirement, which may force local insurers having problems raising capital to joint venture with foreign partners.

These are only a few of the insights in the new EMD Report : Indonesia Insurance Industry 2H12. Learn more and purchase now>>

Tags: assets, civil service and armed forces insurance, density, foreign ownership, gross claims, gross premiums, Indonesia, insurance, insurance companies, investments, life insurance, net premium, non-life insurance, penetration, PT Asuransi Bina Dana Arta Tbk, PT Asuransi Multi Artha Guna Tbk, PT Panin Insurance Tbk, regulatory developments, reinsurance, retention rate, sharia market, size, social insurance, value

Indian economy saw a period of slowdown in fiscal year 2012. The country recorded a GDP growth of 5.3% in the fourth quarter which was its worst performance in last nine years. However, Indian healthcare industry continued to show resilience in the face of slowdown with leading healthcare players recording a double digit growth, both in revenues and net profits. The industry is growing at a CAGR of 15% and is expected to cross USD 75 bn by the end of calendar year 2012.

The country’s government spending on infrastructure is low, approximately 1.2% of GDP in 2010. Fiscal year 2012 saw a 13% increase in government budget allocation to the flagship programme named National Rural Health Mission (NRHM). The programme has been quite successful in raising the standards of people’s health, healthcare infrastructure and healthcare delivery across the country within a short span of seven years. However, the country is likely to miss the healthcare targets for 2015 under Millennium Development Goals.

Huge demand supply gap exists in the healthcare sector of India. The country was lagging behind in terms of average number of hospitals, hospital beds, doctors, nurses and other paramedical staff. The huge population accompanied with large prevalence of communicable and non-communicable diseases demands large scale development and growth in this sector. Private sector is playing a big role in this regard accounting for more than 70% of country’s health expenditure.

The outlook for Indian healthcare is positive owing to double digit growth rate in almost all of its segments, whether its primary healthcare, secondary and tertiary healthcare, medical equipments, disgonotics, health insurance or medical tourism. The ever growing population, increasing government expenditure on health and growing per capita income will increase the size of this industry in the years to come.

Key Findings

- The Ministry of Health and Family Welfare increased the planned allocation on public health from USD 4.97 bn in FY11 to USD 5.96 bn in FY12, an increase of 20% y/y. The major stressor on the Indian government over the last few years has been raising the standards of rural health. Almost 75% of the government spend was on its flagship programme National Rural Health Mission (NRHM).

- The annual budget outlay for NRHM increased from INR 109 bn in FY08 to INR 178.4 bn in FY12. The budget outlay has grown at a CAGR of 13% during the fiscal period 2008-12.

- The size of India’s healthcare sector was around USD 66 bn as of year 2010. The sector size is expected to cross USD 75 bn by the end of calendar year 2012.

- The existing supply/demand gap is attracting investors to the healthcare sector of the country. In the first half of calendar year 2012, the sector registered 25 deals with a value of USD 749 mn. In the same period in year 2011, it recorded equity investment of USD 208 mn only. Health care received the highest investment, surpassing the long preferred information technology sector, in terms of total private equity investments during this period.

Chart: Private Equity Investments in First Half of Calendar Year 2012 (In USD Mn)

Source: The Economic Times

Much more in the Emerging Markets Direct report: India Healthcare Industry 1H12

Tags: Apollo Hospitals, AYUSH, Beds, Birth, Child Mortality, Equipments, Fortis Healthcare, government, health insurance, Hospital, Human Resources, Infant Mortality, Infrastructure., Keywords: National Rural Health Mission (NRHM), Maternal Mortality, Medical Tourism, Ministry of Health, Opto Electronics., private sector, Shortage, size

Consistent with Indonesia’s robust economic growth, the domestic banking industry continued to post significant gains in 2011. Total assets of banks in Indonesia stood at IDR 3,653tn as of December 2011, an increase of 21.4% y/y, while the asset quality remained strong over the same period. Total lending reached IDR 2,200tn in 2011, up 24.6% y/y. The increase occurred across all segments, both for working capital and consumption loans for both business and consumer lending.

On the funding side, total third party funds grew 19.1% y/y to IDR 2,785 in 2011, with increases in funding across all types of third party funds (savings, time and demand deposits). Faster paced growth in lending compared to that of funding resulted in a higher loan-to-deposit ratio (LDR) in 2011.

The overall performance of the Indonesian banking system improved in 2011, with banks achieving higher net interest margin (NIM) of 5.9% and industry’s profits rising to IDR 75tn. The banking industry’s capital also remained at a healthy level at 16.1% due to strong sector profitability.

The five leading banks in Indonesia recorded strong financial performance in 2011, thanks to favourable economic environment. Total loans were up with strong growth across all customer segments, while net income increased due to strong growth in lending and transaction accounts.

Key Findings

- Total third party funds increased across all types in 2011, with saving deposits recording the highest growth rate of 22.5% y/y, followed by demand deposits (21.8%) and time deposits (15.3%).

- The industry’s net profits reached IDR 75tn in 2011, up 31.6% from IDR 57tn in 2010 with strong growth in NIM and loan portfolio.

Indonesian Banking Sector Highlights (IDR tn)

Source: Bank of Indonesia

These are only a few of the findings in the new Indonesia Banking Industry report. Learn more and purchase now>>

Tags: Bank Mandiri (BMRI) Bank Rakyat Indonesia (BBRI) Bank Central Asia (BBCA) Bank Negara Indonesia (BBNI) Bank Danamon Indonesia (BDMN), banking, capital adequacy ratio, comparative matrix, financial highlights, Indonesia, interest rates, Islamic banking, loan-to-deposit ratio, micro small medium enterprises, net interest income, net interest margin, non-performing loans, profit, return on assets, return on equity, rural banks, size, SWOT analysis, total assets, total credits, total deposits, total loans, value

Ukraine seems interested in developing own shale gas resources as a diversification from predominant Russian imports, but the business climate in the country looks problematic. The state is very interested in energy projects; however investors are cautious of moving into Ukraine’s energy business at the moment, as this often meant joining up or competing with state-based organizations, or groups that could be linked to state officials or their relatives.

Ukraine has significant shale oil gas reserves, according to the existing estimates, equal to those of Sweden and roughly one quarter of the reserves of the major reserve holders Poland and France. OECD/IEA indicates roughly 1,100bn m3 of gas reserves. Wood Mackenzie however indicates that the Lublin basin, in Poland, could have reserves in excess of 1,400bn m3 and have equal reserves in the Ukrainian portion of the basin.

Main shale gas basins in Ukraine [Source: Advanced Resources International, IntelliNews]

With Europe’s fourth largest shale gas reserves according to the OECD/IEA, and hopes for even more as supported by prognoses like those put forth Wood Mackenzie and others, the production stakes in Ukraine have aroused international interest. Exploration on the Ukrainian side of the border so far has been narrow however. This is largely the purview of internationals. TNK-BP, Gazprom and Shell are looking at Ukrainian exploration. There are also several junior explorers, such as Eurogas, actively exploring in Ukraine.

This is only a small extract of the insights in the IntelliNews Special Report, Ukraine Shale Gas Sector; read more and purchase>>

Tags: Balchem, Cadogan, Chevron, cost, development, East Europe, economy, Eni, export, Exxon Mobil, frackling technology, Gasfrac Energy Services, Gazprom, government, hydraulic, import, investors, KUB-Gas, Natural Gas, OMV, OMV Petrom, politics, price, production, profits, risk, Russia, shale gas, Shell, size, Svenska Capital, technologies, TNK-BP, TPAO, Trican Well, Ukraine

Poland is in the front line of Europe’s shale gas operations. According to the Environment Ministry’s data, 18 research drillings were successfully conducted and 14 another were under preparation. Still these drills are not enough to reasonably assess the actual potential for commercial use of shale gas. Even if the existence of gas is confirmed, it does not necessarily mean that there is potential for commercial use. From the tests made so far, the only concession, which may hold a satisfying amount of gas is PGNiG’s Wejherowo concession in Lubocin.

Apart from uncertain resources, experts mention several other potential barriers, which may increase the risk for shale gas investors in Poland and may even make such investments unreasonable:

- Protectionism of local service sector especially regarding drilling firms

- Restrictions to foreign drilling firms to enter the Polish market (for example a requirement to operators of drilling equipment to have local permissions)

- Long lasting procedures for importing the drilling equipment from outside the EU

- The necessity to announce tenders for drilling operations;

- Uncertainty concerning the price of gas on the regulated market;

- Complicated regulation concerning access to geological information and high price of such information;

- Changing and unclear regulation regarding the environment protection.

This is only a short extract from all the insights provided in the IntelliNews Special Report, Poland Shale Gas Sector; read more and purchase>>

Tags: 3 Legs resources, Balchem, Bulgaria, Chevron, cost, development, East Europe, economy, Eni, export, Exxon Mobil, frackling technology, Gasfrac Energy Services, Gazprom, government, hydraulic, import, investors, KGHM, Lotos, Marathon Oil corporation, Natural Gas, OMV, OMV Petrom, Petrolinvest, PGNiG, PKN Orlen, Poland, politics, price, production, profits, risk, Romania, San Leon Energy, shale gas, Shell, size, technologies, TNK-BP, TPAO, Trican Well, Turkey, Ukraine

In the US, 12 years after the start of significant operation, shale gas flows reached some 170bn m3. The real impact was visible in the second half of the cycle, when supplementary non-conventional gas pushed exports and consumption up and imports down.

Will this be the case in Europe? Our findings point to the fact that even if certain areas of the continent (Eastern Europe particularly) are strongly interested in grasping this opportunity, a would-be shale boom in Europe reach neither the magnitude nor the speed of development seen in the US.

Europe will rather seek to diversify its external gas resources by building LNG terminals or investing in pipeline to gas rich regions. Actually, the shale gas at global level will not reach the magnitude seen in the US recently, as suggested by the consensus projections.

More detail, including extensive analysis of markets, technologies, political landscape and specific businesses, in the IntelliNews special report, East Europe Shale Gas Sector; read more and purchase>>

Tags: Balchem, Bulgaria, Chevron, cost, development, East Europe, economy, Eni, export, Exxon Mobil, frackling technology, Gasfrac Energy Services, Gazprom, government, hydraulic, import, investors, Natural Gas, OMV, OMV Petrom, Poland, politics, price, production, profits, risk, Romania, shale gas, Shell, size, technologies, TNK-BP, TPAO, Trican Well, Turkey, Ukraine