Indonesia’s property industry has been booming in recent years with rising profits for property companies and property prices soaring throughout 2012. Despite the European debt crisis and global slowdown, Indonesia’s economy grew by 6.2%, continued to attract foreign direct investment. The country’s positive economic conditions and a growing middle-class have boosted domestic demand. This has increased developer confidence, leading to a jump property projects in Indonesia. Sales and rental rates have increased by an average of 10-20% during 2012.

The strong economy and improved investors’ sentiment have significantly increased demand for office space in Jakarta’s CBD area, which have shot up office rents and occupancy rate over 95% in 2012. Meanwhile, rising domestic consumption has encouraged retailers to expand their business, leading to higher occupancy levels and rental rates of retail space. The country’s improved tourism sector has also stimulated hotel development projects, ranging from 3-star to 5-star hotels.

Blessed with gains from the favorable economic conditions, property developers performed remarkably well in 2012 with new project launches and higher revenues. The sector is expected to remain firm in 2013 due to stable economic growth, controlled inflation and rising purchasing power. However, a risk to Indonesia’s property sector is the hike in the price of subsidized fuel which will result in a higher central bank interest rate, making it more expensive for Indonesians to buy a mortgage. Nonetheless, forecasters expect property prices to increase along with occupancy rates.

Key Findings

- Capitalising on the rapid economic growth and solid domestic demand, Jakarta’s CBD office market continued to expand with occupancy rates above 95% in Q1/2013.

- With conducive economic conditions and rising domestic demand, new apartment and retail projects are expected to enter the market in 2013. The average rental rates and occupancy rates are also expected to increase.

- Given the limited stock of industrial land, land prices have increased by 10.5% q/q alone in Q1/2013 with occupancy rates rising slightly to 65.9%.

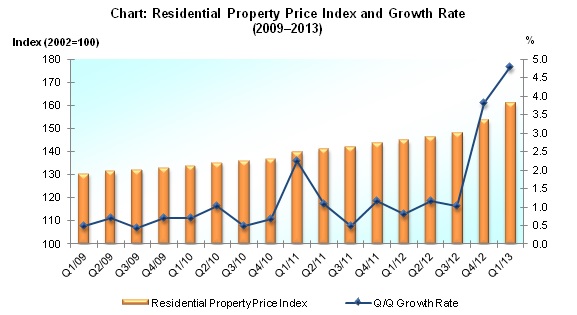

- According to a survey by Bank Indonesia, housing prices in 14 major cities grew by 11% y/y and 4.8% q/q in Q1/2013 on the back of stable economic growth, controlled inflation and rising middle-income segment.

Source: Bank Indonesia’s Residential Property Survey

This is just a quick glimpse into the EMD Report: Indonesia Property Industry. Learn more now>>