The Indian banking industry has witnessed a period of steady growth during the last decade, with banks along with their customers embracing robust systems and processes. The industry has recorded a consistent rise in the number of reporting offices in last few years. With Reserve Bank of India stressing the policy of financial inclusion, there has been a renewed emphasis on rural expansion. However, a large part of Indian village population still remains without banks. It will require further expansion from Indian banks to raise the penetration levels of banking services in the country, especially in rural areas, home to more than 65% of Indian population.

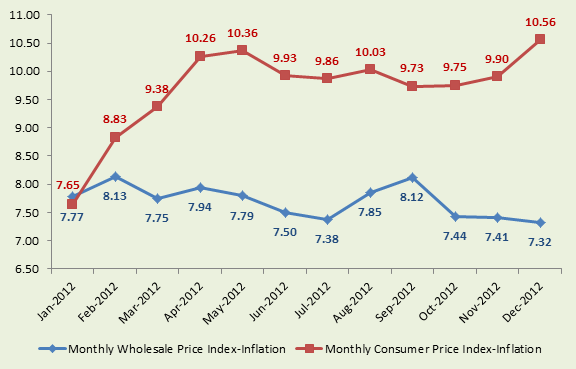

Following rapid growth experienced in the past few years, the Indian banking industry experienced a slowdown in FY13. Persistent high inflation forced the RBI to maintain the benchmark interest rate at high levels. This slowed down the credit off take in the country, which led to an industrial slowdown. Except agricultural loans and personal loans, all other sectors recorded subdued loan growth. High inflation also eroded domestic savings, resulting in a lower deposit growth. However, higher interest rates and volatile market conditions attracted more depositors towards the high yielding and risk free term deposits of scheduled commercial banks. The prevailing adverse economic conditions deteriorated the asset quality of the commercial banks, particularly the public sector banks. High interest rates during the period led to a sharp increase in non-performing assets in public sector banks, bringing their profitability under pressure. The government of India has embarked upon a need-based recapitalization of public sector banks so that they can comply with Basel III norms. The norms will be fully phased in by March 31, 2018.

In a recent development, the Reserve Bank of India finalized the guidelines on licensing of new banks in the private sector. It also invited applications for licenses from eligible promoters with a cut-off date of July 1, 2013. Hence, the long term outlook for Indian banking sector is stable because of a large unbanked population, rising per capita income and a growing middle class. Emergence of new players and technology upgrades will further add to the growth of this sector.

Key Findings

- As of March 31, 2012, the total assets of scheduled commercial banks of India were around INR 83tn (USD 1.5tn). In the 2007-12, the total assets of the scheduled commercial banks grew at a CAGR of 19.1%.

- In January 2013, the Reserve bank of India cut the CRR (cash reserve ratio) by 25 basis points to 4% to infuse an amount equivalent to INR 180bn in the banking system. Since January 2012, the CRR has effectively been cut by 2% points which has infused a liquidity equivalent to INR 1,325 bn into the banking system. RBI used it as an alternate route to revive growth in 2012.

- In December 2012, the total loans and advances of the banking system grew by 17.6% y/y. Investment grew by 14.4% while balances with banks and money at call or short notice grew by 1.7%. Balances with RBI registered a steep decline of 15.2% as a result of reduction in CRR rate.

- Total deposits of scheduled commercial banks grew by 11% y/y at the end of December 2012. This was much below its long term growth trend of 19%. High inflation caused an erosion in the domestic savings of people, resulting in subdued growth in deposits.

Chart: Inflation during calendar year 2012-India (in %)

Source: RBI

This is just a quick glimpse into the EMD Report: India Banking Industry. Learn more and purchase now>>