Short-term indicators pointed to weak activities in May – a pattern shaped by the Easter holidays in 2013 and 2012. The whole period between Apr-May, defined ad-hoc in order to avoid the impact of Easter, industrial activity [output, exports] remained robust – and it even accelerated from Q1. Constructions activity – including investments lagged behind. The budget adjustment operated at end-July might keep public investments under pressure in spite of the government loosening fiscal gap target for the year to 2.3% from previous GDP of 2.1%. The loosening was prompted by low revenues and rising financial needs.

In the banking sector, loans turned to negative annual dynamic [nominal] and the share of bad loans kept rising. Moody’s rating agency said it has downgraded the long-term deposit ratings by two notches on Romania’s largest banks BCR – Erste Group and BRD – Societe Generale. The outlook is negative. Given the size of the two banks, the downgrade is rather relevant for the entire country’s banking system.

The Romanian government will make public on July 31 the details of the follow-up stand-by agreement with the IMF and the EU, PM Victor Ponta announced.

The details of the new agreement were already sketched, he stressed, but last-minute adjustments are possible. Notably, the PM’s statement confirmed that the EU will join IMF in the new agreement with Romania – after speculations had put under doubt EU’s partaking in the Fund’s new deal.

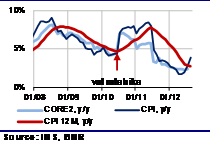

The adjusted CORE2 inflation calculated by Romania’s central bank accelerated to 2.85% y/y at the end of June from 2.65% at the end of May, the monetary authority said. On the quarter, it decelerated from 3.03% at end-March.

The target for end-Q2, under the latest inflation forecast issued in May, was 2.6%. The least volatile indicator of consumer price inflation thus missed the target by 25bps, threatening the end-year 2.1% y/y target.

Romania’s central bank on Monday, July 1, cut by 25bps to 5% its monetary policy interest rate for the first time since February 2012, the monetary authority said. The move was announced as imminent by governor Mugur Isarescu several months ago.

The central bank quoted disinflation as the main ground for the cut, while on the other hand strongly recommending commercial bankers to unlock lending. Nonetheless, with the monetary transmission mechanism hardly functioning, the central bank’s rhetoric is debatable. The rate cut is rather aimed at bringing the monetary policy rate in line with the market than pursuing any particular policy.

Read more in Intellinews’s comprehensive report, Romania Country Report>>

Tags: balance, bank loans, budget, debt, deficit, deposits, finance, fiscal, foreign trade, Forex, government, IMF, inflation, labour, macroeconomy, policy, politics, prices, Raiffeisen Romania, real sector, Romania, unemployment

Over the last ten years, the Indian aviation industry witnessed a period of high growth, with total passenger traffic growing at a CAGR of around 18% during 2003-11. The industry has also helped in stimulating other sectors of economy such as tourism, hospitality and trade. However, over the last 18 months, the industry went through a period of subdued growth, particularly in domestic passenger traffic.

FY13 was a good year in terms of international passenger traffic growth for scheduled Indian carriers. The industry was also able to bring down its losses by a great extent. Yet, all scheduled Indian air carriers except IndiGo, incurred losses in the year. High airport charges, deprecation of the Indian rupee, expensive aircraft turbine fuel and low air fares were the major challenges faced by the carriers in FY13. The year also saw discontinuation of services of Kingfisher Airlines as a result of severe financial crisis. Much awaited FDI policy allowing investment by foreign airlines in the sector was also cleared in September 2012.

Low cost carriers gained significant market share during the first five months of 2013. IndiGo became the largest carrier upstaging Jet Airways in the domestic market. In terms of operating performance, IndiGo emerged as the best carrier on many parameters.

Despite the challenges, the rising middle class and consistent growth in tourism bodes well for the aviation sector. Depreciation of rupee, rise in fuel prices and highly leveraged balance sheets are the biggest challenges for the sector.

Salient Points

- In the first five months of 2013, domestic passenger traffic of scheduled Indian carriers grew by 0.8% y/y. International passenger traffic, meanwhile, declined by 9% y/y in the first four months of 2013.

- In the first four months of 2013, domestic cargo carried by Indian carriers grew by 1.1% y/y while international cargo contracted by 4.3% y/y.

- The utilization of available capacity for scheduled domestic carriers was around 78% for the first five months of 2013. IndiGo recorded the highest passenger load factor, followed by GoAir.

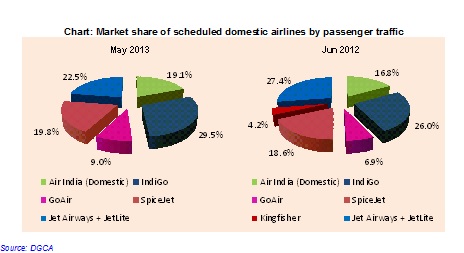

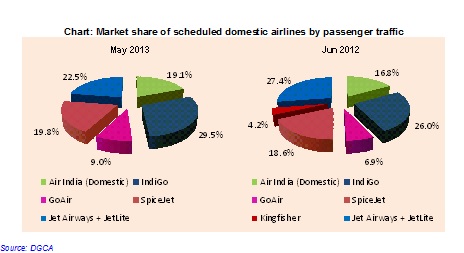

- At the end of May 2013, IndiGo became the largest domestic carrier with a market share of 29.5%, rising from 26% share in June 2012. Jet Airways’ (combined with JetLite) share declined from 27.4% to 22.5% but was able to hold on to its second spot. SpiceJet held to its third position on the list with a market share of 19.8%.

Read more in EMD’s comprehensive report, India Aviation Industry>>

Tags: Air India, Airbus, Aircraft, Airport, Boeing, Cargo, debt, DGCA, Domestic, Fleet, fuel, Full service, GMR Infra, GoAir, IndiGo, International, Jet Airways, Kingfisher, loss, Low cost carriers, Ministry of Civil Aviation, Passenger Traffic, Scheduled Indian carriers, SpiceJet

Slow reforms in state owned companies indicate that the final review [and completion] of the stand-by arrangement with IMF will probably be shifted towards the end of 2013 – from initially April 2013. Officially, the Fund’s team is expected to run the final review in June and submit the conclusions to the Board in July.

At least three state controlled companies are in critical state: cargo railway company CFR Marfa, chemical plant Oltchim and postal company Posta Romana. The government admitted there are three bidders for CFR Marfa – however they are unlikely to boost the activity of the debt-ridden railway company.

The government also claims that there are still investors interested in Oltchim – but it has yet to start on any privatisation procedure. It is unlikely that any serious investor would show up at such short notice.

For Posta Romana, the government postponed starting the privatisation procedures from May 28 to six months later. This proves of delayed plans of SBA with IMF to yearend.

Read more in EMD’s comprehensive report, Intellinews Romania Country Report>>

Tags: balance, bank loans, budget, debt, deficit, deposits, finance, fiscal, foreign trade, Forex, government, IMF, inflation, labour, macroeconomy, policy, politics, prices, real sector, Romania, unemployment

The capitalisation of investment funds sold on the Romanian market increased by more than EUR 2bn from some EUR 0.2bn at the end of 2008. By comparison, households’ bank deposits increased by EUR 5bn.

Romanian banks might face one more hurdle in their activity: rising competition for households’ savings. The investment funds are a viable alternative to bank deposits and they provide higher yields [at higher risk]. As the banks cut deposit rates, household shift their savings to monetary investment funds. Once the funds gain respectability, those with higher risks [like share funds] will be an alternative and private pension funds will also predictably gain ground.

These are only a few of the insights in the new Intellinews Report : Romania Country Report. Learn more and purchase now>>

Tags: balance, bank loans, BRD-SocGen, budget, debt, deficit, deposits, finance, fiscal, Fitch, foreign trade, Forex, government, IMF, inflation, labour, macroeconomy, policy, politics, prices, real sector, Romania, unemployment

Romania’s public debt edged up a modest 0.1pps ytd to 34.8% of GDP [ESA methodology] at the end of October 2012 – after it nearly tripled since the end of 2008. The domestic public debt expanded sharply by more than three times while the external public debt advanced at a slower pace yet still more than doubling. Notably however, a large part of the domestic debt is denominated in foreign currency – actually more than half of it [54.8% at the end of October].

Romania public debt

Much more in the EMD report: Romania Country Report

Tags: bank, BCR, budget, constructions, debt, deficit, deposit, EBRD, fiscal, Fitch, forecasts, foreign, Forex, forex reserves, GDP, government, industry, inflation, insurance, JP Morgan, labour, loan, market, politics, prices, profit, real sector, retail, Romania, sales, spending, stock, unemployment, wages

Romania’s central bank has raised the year-end inflation projections by 1.9pps to 5.1% y/y for 2012 and by 0.5pps to 3.5% y/y for 2013, according to its Quarterly Inflation Report released on Nov 7. The IMF expert team visiting Romania expressed concerns with the price stability.

Consumer price inflation eased to 5% y/y in October after peaking to 5.3% y/y in September, the statistics office reported. CORE2 inflation was 3.2% y/y in September. The average consumer prices in the 12 months ending October were 3.1% up y/y, accelerating from 3% y/y growth registered last month.

PLUS:

FOCUS STORY: Are there grounds for euroscepticism in Romania?

This is only a small extract of the insights in the new Intellinews : Romania Country Report; read more and purchase now>>

Tags: bank, BCR, BRD-SocGen, budget, constructions, debt, deficit, deposit, EBRD, fiscal, Fitch, FOB, forecasts, foreign, Forex, forex reserves, GDP, government, industry, inflation, insurance, labour, loan, market, politics, prices, profit, real sector, retail, Romania, sales, spending, stock, unemployment, wages

Romania’s economy increased by 0.7% y/y in H1 and will end with negative for the year, less than -1%. Bullish expectations were ruined by poor use of EU funds and by below-average agricultural production. The IMF and the government expect a much stronger advance in 2012 of 2.5%, according to the Fund’s World Economic Outlook. But even this will not help the country return to pre-crisis 2008 GDP levels.

Romania’s statistics office revised the estimate for the country’s Q2 GDP to 1.1% y/y, down from 1.2% y/y previously announced on September 6, according to the newly introduced T+95 estimate. The adjustment is minor and does not send positive signals for the country’s economic growth, already expected to slow in H2.

These are only a few of the insights in the new IntelliNews : Romania Country Report. Learn more and purchase now>>

Tags: bank, BCR, budget, constructions, debt, deficit, deposit, EBRD, fiscal, forecasts, foreign, Forex, forex reserves, GDP, government, industry, inflation, insurance, labour, loan, market, politics, prices, profit, real sector, retail, Romania, sales, spending, stock, unemployment, wages

Romania’s seasonally-adjusted GDP edged up by 0.5% q/q in Q2, after it has stagnated for three years around the same level. Against the past quarter, the domestic demand strengthened robustly driven by both consumption (1.6% up q/q) and gross fix capital formation (gfcf, 4.4% up q/q). On the opposite, the external demand weakened visibly by 1.4% q/q. The imports edged up by 1.2% q/q contributing, besides the export’s weakening, to the deterioration of the external balance.

GDP and main elements by utilisation, quarterly, seasonally adjusted [2000=100]

These are only a few of the insights in the new IntelliNews : Romania Country Report. Learn more and purchase now>>

Tags: bank, BCR, budget, constructions, debt, deficit, deposit, EBRD, fiscal, forecasts, foreign, Forex, forex reserves, GDP, government, industry, inflation, insurance, labour, loan, market, politics, prices, profit, real sector, retail, Romania, sales, spending, stock, unemployment, wages

India’s GDP grew by 5.3% in the fourth quarter of fiscal year 2012, recording its worst performance in the last nine years. This slowdown in growth was primarily a result of high inflation, high interest rates and policy paralysis. Indian aviation industry had a good year in terms of passenger traffic growth but one of its worst in terms of profitability.

All scheduled Indian air carriers except IndiGo, incurred losses in the year. Kingfisher Airlines and Air India suffered from several payment defaults and pilot strikes. Their flight schedules were disturbed many times during the year.

The total loss for all the airlines during the period 2008-11 was around USD 4 billion and for FY12 was approximately USD 2 billion according to the Ministry of Civil Aviation. High airport charges, depreciation of Indian rupee, expensive aircraft turbine fuel and low air fares were the main reasons cited by the companies for their successive losses. According to the Center for Asia Pacific Aviation (CAPA) the combined debt of Indian airline companies was around USD 15 Billion as of March 2012.

All was not bad as Indian aviation witnessed growth, both in domestic as well as international passenger traffic in first six months of calendar year 2012. Domestic passenger traffic grew by 11% in calendar year 2011 and by 4% in first six months of calendar year 2012. International passenger traffic registered 8% growth in first six months of calendar year 2012 after contracting by 19% in calendar year 2011. The working group on civil aviation for 12th Five Year Plan expects the international passenger traffic to touch 60 million and domestic passenger traffic to touch 209 million by year 2016.

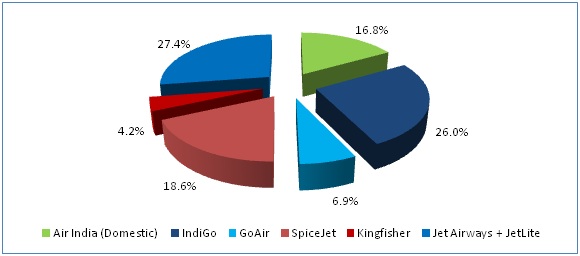

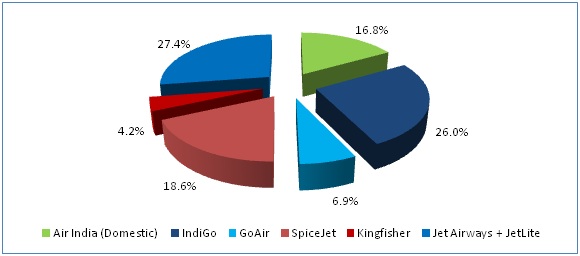

Low cost carriers gained significant market share during the first six months of year 2012. IndiGo became the second largest carrier in the domestic market with a share of 26% while SpiceJet became third with a share of 18.6%. Together, the low cost carriers held a market share of more than 58%. Kingfisher saw substantive erosion in its market share and slipped to the sixth position, below GoAir. In terms of operating performance, IndiGo emerged as the best carrier on many parameters. It held the best position in terms of on time performance, employee to aircraft ratio, flight cancellation data and passenger load factor. IndiGo was also the only carrier which made profits in the fiscal year 2012 according to Ministry of Civil Aviation.

Chart: Market Share of Scheduled Domestic Airlines (June 2012)

Source: DGCA

These are only a few of the insights in the new India Aviation Industry Report. Learn more and purchase now>>

Tags: Air India, Airbus, Aircraft, Airlines, Airport, Boeing, Cargo, debt, Domestic, Fleet, fuel, Full service, GoAir, IndiGo, Jet Airways, Kingfisher, loss, Low cost carriers, Passenger Traffic, Scheduled Indian carriers, SpiceJet

The stock of provisions held by the Romanian banks increased by RON 3,161mn (EUR 722mn, or some 0.9% of their assets) in the first quarter of 2012, according to IntelliNews calculations based on the central bank data. Romania’s non-performing loans ratio reached 15.88% at the end of March, up from 14.33% at the end of 2011 and 12.71% at the end of March 2011. The loan loss provision cost thus neared the record level of EUR 747mn registered back in the second quarter of 2010, marking a visible deterioration from the moderate EUR 171mn provision cost in Q4/2011 or the average quarterly provision cost of EUR 416mn last year.

The banks derived an aggregate profit of EUR 28mn in Q1, according to IntelliNews calculations. The aggregate profit was close to zero in the final quarter of last year, according to adjusted data, while the banks incurred losses of EUR 181mn in full 2011 – compared to a combined loss of EUR 79mn reported the under preliminary [unrevised] data. The Romanian banks also posted an aggregate loss of EUR 123mn in 2010.

These are only a few of the findings in the new Intellinews Romania Country Report. Learn more and purchase now>>

Tags: bank, budget, constructions, debt, deficit, deposit, EBRD, fiscal, forecasts, foreign, forex reserves, GDP, government, industry, inflation, insurance, labour, loan, market, politics, prices, profit, real sector, retail, Romania, sales, spending, stock, unemployment, wages