Over the last ten years, the Indian aviation industry witnessed a period of high growth, with total passenger traffic growing at a CAGR of around 18% during 2003-11. The industry has also helped in stimulating other sectors of economy such as tourism, hospitality and trade. However, over the last 18 months, the industry went through a period of subdued growth, particularly in domestic passenger traffic.

FY13 was a good year in terms of international passenger traffic growth for scheduled Indian carriers. The industry was also able to bring down its losses by a great extent. Yet, all scheduled Indian air carriers except IndiGo, incurred losses in the year. High airport charges, deprecation of the Indian rupee, expensive aircraft turbine fuel and low air fares were the major challenges faced by the carriers in FY13. The year also saw discontinuation of services of Kingfisher Airlines as a result of severe financial crisis. Much awaited FDI policy allowing investment by foreign airlines in the sector was also cleared in September 2012.

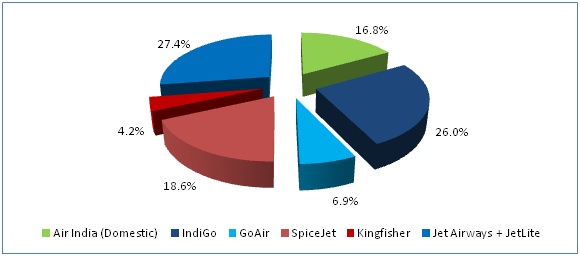

Low cost carriers gained significant market share during the first five months of 2013. IndiGo became the largest carrier upstaging Jet Airways in the domestic market. In terms of operating performance, IndiGo emerged as the best carrier on many parameters.

Despite the challenges, the rising middle class and consistent growth in tourism bodes well for the aviation sector. Depreciation of rupee, rise in fuel prices and highly leveraged balance sheets are the biggest challenges for the sector.

Salient Points

- In the first five months of 2013, domestic passenger traffic of scheduled Indian carriers grew by 0.8% y/y. International passenger traffic, meanwhile, declined by 9% y/y in the first four months of 2013.

- In the first four months of 2013, domestic cargo carried by Indian carriers grew by 1.1% y/y while international cargo contracted by 4.3% y/y.

- The utilization of available capacity for scheduled domestic carriers was around 78% for the first five months of 2013. IndiGo recorded the highest passenger load factor, followed by GoAir.

- At the end of May 2013, IndiGo became the largest domestic carrier with a market share of 29.5%, rising from 26% share in June 2012. Jet Airways’ (combined with JetLite) share declined from 27.4% to 22.5% but was able to hold on to its second spot. SpiceJet held to its third position on the list with a market share of 19.8%.

Read more in EMD’s comprehensive report, India Aviation Industry>>