Short-term indicators pointed to weak activities in May – a pattern shaped by the Easter holidays in 2013 and 2012. The whole period between Apr-May, defined ad-hoc in order to avoid the impact of Easter, industrial activity [output, exports] remained robust – and it even accelerated from Q1. Constructions activity – including investments lagged behind. The budget adjustment operated at end-July might keep public investments under pressure in spite of the government loosening fiscal gap target for the year to 2.3% from previous GDP of 2.1%. The loosening was prompted by low revenues and rising financial needs.

In the banking sector, loans turned to negative annual dynamic [nominal] and the share of bad loans kept rising. Moody’s rating agency said it has downgraded the long-term deposit ratings by two notches on Romania’s largest banks BCR – Erste Group and BRD – Societe Generale. The outlook is negative. Given the size of the two banks, the downgrade is rather relevant for the entire country’s banking system.

The Romanian government will make public on July 31 the details of the follow-up stand-by agreement with the IMF and the EU, PM Victor Ponta announced.

The details of the new agreement were already sketched, he stressed, but last-minute adjustments are possible. Notably, the PM’s statement confirmed that the EU will join IMF in the new agreement with Romania – after speculations had put under doubt EU’s partaking in the Fund’s new deal.

The adjusted CORE2 inflation calculated by Romania’s central bank accelerated to 2.85% y/y at the end of June from 2.65% at the end of May, the monetary authority said. On the quarter, it decelerated from 3.03% at end-March.

The target for end-Q2, under the latest inflation forecast issued in May, was 2.6%. The least volatile indicator of consumer price inflation thus missed the target by 25bps, threatening the end-year 2.1% y/y target.

Romania’s central bank on Monday, July 1, cut by 25bps to 5% its monetary policy interest rate for the first time since February 2012, the monetary authority said. The move was announced as imminent by governor Mugur Isarescu several months ago.

The central bank quoted disinflation as the main ground for the cut, while on the other hand strongly recommending commercial bankers to unlock lending. Nonetheless, with the monetary transmission mechanism hardly functioning, the central bank’s rhetoric is debatable. The rate cut is rather aimed at bringing the monetary policy rate in line with the market than pursuing any particular policy.

Read more in Intellinews’s comprehensive report, Romania Country Report>>

Tags: balance, bank loans, budget, debt, deficit, deposits, finance, fiscal, foreign trade, Forex, government, IMF, inflation, labour, macroeconomy, policy, politics, prices, Raiffeisen Romania, real sector, Romania, unemployment

Slow reforms in state owned companies indicate that the final review [and completion] of the stand-by arrangement with IMF will probably be shifted towards the end of 2013 – from initially April 2013. Officially, the Fund’s team is expected to run the final review in June and submit the conclusions to the Board in July.

At least three state controlled companies are in critical state: cargo railway company CFR Marfa, chemical plant Oltchim and postal company Posta Romana. The government admitted there are three bidders for CFR Marfa – however they are unlikely to boost the activity of the debt-ridden railway company.

The government also claims that there are still investors interested in Oltchim – but it has yet to start on any privatisation procedure. It is unlikely that any serious investor would show up at such short notice.

For Posta Romana, the government postponed starting the privatisation procedures from May 28 to six months later. This proves of delayed plans of SBA with IMF to yearend.

Read more in EMD’s comprehensive report, Intellinews Romania Country Report>>

Tags: balance, bank loans, budget, debt, deficit, deposits, finance, fiscal, foreign trade, Forex, government, IMF, inflation, labour, macroeconomy, policy, politics, prices, real sector, Romania, unemployment

The capitalisation of investment funds sold on the Romanian market increased by more than EUR 2bn from some EUR 0.2bn at the end of 2008. By comparison, households’ bank deposits increased by EUR 5bn.

Romanian banks might face one more hurdle in their activity: rising competition for households’ savings. The investment funds are a viable alternative to bank deposits and they provide higher yields [at higher risk]. As the banks cut deposit rates, household shift their savings to monetary investment funds. Once the funds gain respectability, those with higher risks [like share funds] will be an alternative and private pension funds will also predictably gain ground.

These are only a few of the insights in the new Intellinews Report : Romania Country Report. Learn more and purchase now>>

Tags: balance, bank loans, BRD-SocGen, budget, debt, deficit, deposits, finance, fiscal, Fitch, foreign trade, Forex, government, IMF, inflation, labour, macroeconomy, policy, politics, prices, real sector, Romania, unemployment

The Polish furniture market has not been completely resilient to the negative global economic developments and shrinking domestic and external demand. After a record year in 2011, when sold production of furniture, as well as exports, registered double-digit annual growth, the market slowed down visibly in 2012. The manufacturers adjusted to the declining demand, restructuring businesses and downsizing output.

Nonetheless, overall Polish companies managed to cope well with the shift in demand and stable profitability rates in the industry are relevant under these conditions.

The turnover profitability rate in the furniture industry in Jan-Sep 2012 remained at the same level as in full year 2011, namely 4.1%, according to official statistics. Prospects for the Polish furniture market remain optimistic, despite the expected slowdown in the short run. The sector remains attractive for foreign investors, who remain highly interested in acquiring or developing production facilities in Poland.

- Furniture industry- Net turnover, profitability rate in 2009-2012

Learn more from our Intellinews report: Polish Furniture Sector

Tags: Abra, Black Red White, distributor, exports, finance, foreign trade, Forte, Fritz Hansen, furniture, Griffin Topco, home furnishing, Ikea, IMS Sofa, industry, investment, Jysk, Mebelplast, Meble Emilia, Poland, price, producer, production, property, reatil, retailer, sales, stores, Swedsood, Swedspan

Foreign banks’ exposure against Romanian banking system down 11% y/y at mid-2012, XR effects filtered out.

The exposure* to Romanian banks of BIS-reporting Western banks, assets alone, decreased sharply by 4.1% q/q in Q2 of 2012, according to our calculations based on BIS data. Q3 data will be released in January 2013. Q2 marked the fifth consecutive quarter of decrease in this regard and the sense of flow for the foreign banks’ resources is unlikely to change any soon. Phasing out foreign currency lending from among the banks’ range of products goes hand in hand with the consolidation of deposit base as the main source of financing for local branches.

* exchange rate adjusted

Assets and liabilities of BIS banks versus Romania [banking and non-banking sector]

![Assets and liabilities of BIS banks versus Romania [banking and non-banking sector]](https://emergingmarketsdirect.files.wordpress.com/2012/12/assets-and-liabilities-of-bis-banks-versus-romania-banking-and-non-banking-sector.jpg?w=645)

These are only a few of the insights in the new Intellinews Report : Romania Financial Sector. Learn more and purchase now>>

Tags: assets, banking, banks, bonds, budget, Citigroup, Coface Romania, credit, deficit, deposits, dividens, finance, Fitch, foreign markets, GDP, government, growth, IFI, IMF, insurance, interest rate, loans, mortgage, National Bank of, profit, property, Romania, stock, UniCredit Tiriac bank

The building materials market improved its performance within the construction industry in 2011, recovering from a two years decline from 2009 – 2010.

Nonetheless, as large infrastructure works neared completion ahead of the Euro 2012 championship, the consumption of construction materials also reduced in tandem. Official statistics show that output of most building materials witnessed annual decline in Jan-Sep 2012 and chances are that full-year performance will also be on the negative side.

Considering the high comparison base, the decrease is however not worrying and players expect the demand previously coming from large road infrastructure projects to be replaced by works in alternative areas, such as rail and energy.

In the short run, the industry will still face difficult times but market players have already redesigned strategies in order to cope with shrinking domestic demand.

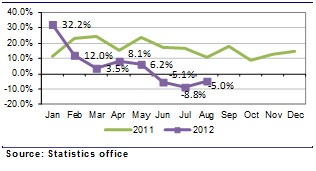

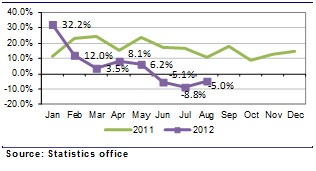

Construction assembly production index in 2011-2012 (monthly, y/y)

Much more in the Intellinews report: Polish Construction Materials Sector >>

Tags: Armatura Krakow, Barlinek, bathroom, building materials, cement, Cemex, ceramic, Concrete, construction, construction chemicals, Etex, Ferrum, finance, fire safety systems, flooring, forecast, GDP, Gorazdze, growth, Grupa Ferro, Grupa Kety, investment, Lafarge, Lindab, LUG, market, materials, Megaron, Mercor, metal constructions, NewConnect, Nowa Gala, Pfleiderer Grajewo, plywood, Poland, Pozbud, price, production, residential, retail sales, revenue, sales, Selena, tiles, Tubadzin, Ulma Construccion Polska, wooden window

Poland’s advertising market growth slowed down visibly in 2011 and projections for 2012 are rather pessimistic. After a poor performance Q1, the Euro 2012 soccer championship did not show the expected positive impact upon the advertising market in Q2, as many companies adopted a cautious behaviour on such expenditures. Accordingly, market players expect the advertising market to drop by 0.4-5% y/y in full year 2012.

The online segment, on the other hand, seems resilient not only to overall economic factors, but also to the cautious behaviour showed by advertisers for the other channels. The Polish e-book market and mobile press are developing at an accelerated pace, while DTH TV providers invest in web VoD and DVB-H mobile TV services. Companies will likely continue to be interested in building new channels of distribution and the online media is expected to become soon the second news source in the country, after television.

Advertising market segmentation in 2011-2012 (% in total)

These are only a few of the insights in the new IntelliNews : Polish Media Sector Report. Learn more and purchase now>>

Tags: advertising, Agora, Agora Helios, cinema, competition, Cyfrowy Polsat, distributor, e-book, entertainment, finance, Gremi Media, internet, market, media, Mobile, online, PMPG, Polish, press, printed media, radio, revenue, Ruch, sales, spending, television, TVN, TVP

Romanian banks incurred aggregated losses of RON 325mn (EUR 73mn at eop XR) in Q2, 2012, according to our calculations based on central bank data. Out of 41 banks, 23 reported profits and 18 losses, according to unofficial data leaked from the central bank. The banking system thus dipped back into the red after it posted aggregated RON 125mn (EUR 29mn, @ eop XR) profit in Q1.

Big picture: dividends vs. interest incomes derived by BIS-reporting banks in Romania [and elsewhere in region].

Nonetheless, this picture has to be put in the context of foreign financial groups. The foreign banks derive two types of benefits from their Romanian subsidiaries: firstly via dividends [probably the smallest portion of the benefits these days, most of the time re-invested when they were higher in the past] and secondly via the interest for the money lent at an interest rate that is driven by the country’s sovereign rating – meaning at high interest rates. The ROA for the foreign financial groups have thus nothing to do with the ROA reported by their local subsidiaries [assuming they finance their own subsidiaries, which is mostly the case].

Much more in the Emerging Markets Direct report: Romania Financial Sector

Tags: assets, Banca Transilvania, banking, banks, BCR, bonds, budget, credit, deficit, deposits, dividens, Erste, finance, foreign markets, GDP, government, growth, IFI, insurance, interest rate, loans, mortgage, profit, property, Raiffeisen, Romania, stock

![Assets and liabilities of BIS banks versus Romania [banking and non-banking sector]](https://emergingmarketsdirect.files.wordpress.com/2012/12/assets-and-liabilities-of-bis-banks-versus-romania-banking-and-non-banking-sector.jpg?w=645)